Learn what statement matching is, how it works, and how AP teams can use automation to improve accuracy, reduce errors, and strengthen supplier relationships.

For accounts payable (AP) teams, one of the most time-consuming tasks is making sure your records match your suppliers’ records. Even the smallest mismatch can trigger delays, disputes, and cash flow headaches.

That’s where statement matching comes in. It’s the process of comparing supplier statements against your internal AP ledger to confirm every invoice, credit, and payment is accounted for.

In this guide, we’ll break down exactly what statement matching is, why it matters, how it works, and the tools AP teams use to get it done efficiently.

What Is Statement Matching?

Statement matching is the process of comparing the transactions listed on a supplier statement against your internal accounts payable records to ensure they align. he goals of an effective statement audit go beyond simple record checking — they’re about proactively safeguarding the financial integrity of your accounts payable process. Identifying missing invoices ensures no supplier charges are overlooked or delayed, preventing late fees and preserving early payment discounts. Confirming that all credits are applied helps you recover money owed to your organization and avoid leaving unclaimed value sitting on supplier accounts. Detecting duplicate or incorrect payments protects against unnecessary cash outflow, which can strain budgets and complicate reconciliations. Finally, maintaining accurate supplier balances creates a reliable financial foundation, fostering trust with vendors and ensuring your AP ledger reflects reality — a critical factor for audits, compliance, and strategic cash flow management. When these four goals are consistently achieved, your AP department moves from reactive problem-solving to a position of control, efficiency, and credibility.

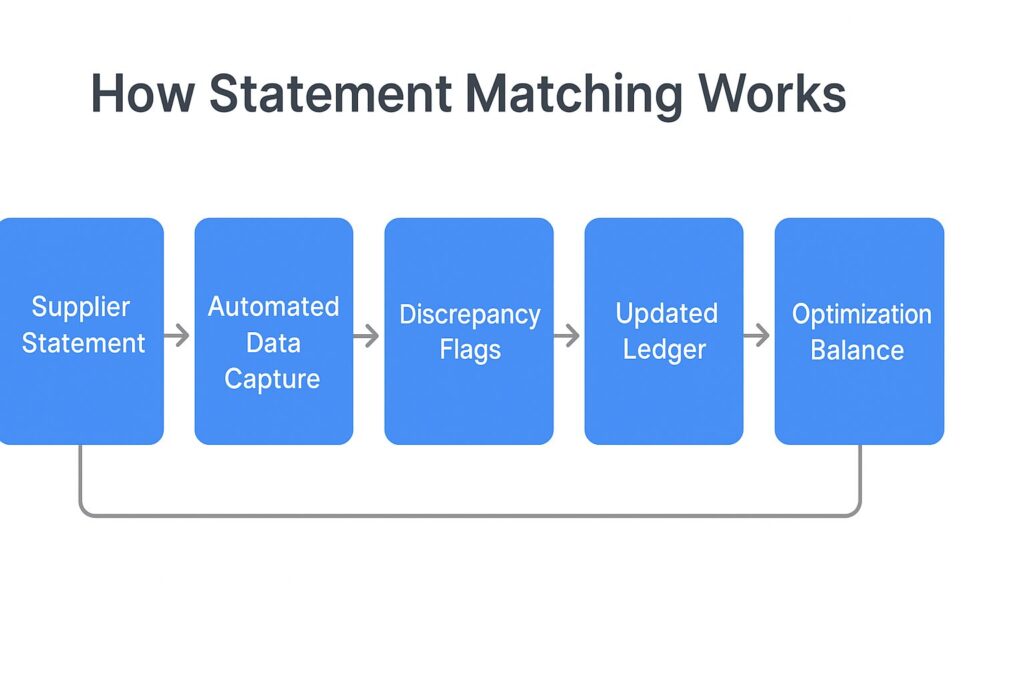

How Statement Matching Works

While the exact process varies, a typical statement matching workflow looks like this:

Step 1 – Collect Statements

Gather monthly or quarterly supplier statements.

Step 2 – Compare Transactions

Match each invoice, credit, and payment to your AP ledger.

Step 3 – Flag Discrepancies

Identify missing, duplicated, or misapplied items.

Step 4 – Resolve Issues

Contact suppliers or adjust internal records to fix errors.

Step 5 – Confirm & Close

Finalize the reconciliation and store documentation.

Why Statement Matching Matters

Without statement matching, AP teams are essentially flying blind. Errors compound, supplier trust erodes, and financial reporting suffers.

Key benefits of regular statement matching:

- Error prevention – Catch issues before month-end close

- Supplier trust – Consistent, accurate payments build credibility

- Cash flow control – Identify unclaimed credits and avoid overpayments

- Audit readiness – Maintain a clean paper trail for compliance

Manual vs. Automated Statement Matching

| Factor | Manual Matching | Automated Matching |

| Speed | Hours to days | Minutes |

| Accuracy | Dependent on staff diligence | 98%+ when data is clean |

| Scalability | Limited | Processes thousands of invoices |

| Audit Trail | Manual notes | Built-in logs & reports |

Automation in Action

Our AP matching automation tools allow you to:

- Import supplier statements in any format

- Automatically match against invoices and credits in your ERP

- Flag only the exceptions for review

- Maintain a complete, searchable history

Automation doesn’t replace your AP team — it gives them the time to focus on higher-value tasks.

Common Statement Matching Errors

To see what can go wrong, read our full guide on common statement matching errors.

The most frequent issues:

- Missing invoices never recorded

- Credits issued but never applied

- Duplicate invoice numbers in the ledger

- Timing mismatches between supplier and AP records

Mini Case Study

A logistics company processing 400+ supplier statements monthly reduced matching time from 6 days to under 6 hours by switching from manual spreadsheets to automation. Result:

- 85% faster matching cycle

- 70% fewer disputes with suppliers

- $40k recovered in unapplied credits in the first year

When to Use Statement Matching

- Month-End Close – Ensures balances are accurate before reporting

- High-Volume Suppliers – Weekly matching prevents backlog

- Before External Audits – Clean records reduce audit prep time

Frequently Asked Questions

Q1: Is statement matching the same as reconciliation?

No — reconciliation checks balances, statement matching verifies individual transactions.

Q2: How often should we run statement matching?

Monthly for all suppliers; weekly for high-volume vendors.

Q3: What’s the biggest advantage of automation?

Speed and accuracy — automation can process hundreds of statements in minutes.

Q4: Does it work with non-PO invoices?

Yes — statement matching applies to both PO and non-PO invoices.

Statement matching is one of the most important controls in the AP cycle. Done manually, it’s slow and error-prone. Done with automation, it becomes a fast, accurate safeguard for supplier relationships and financial accuracy.