Why Choosing the Right AP Automation Tool Matters

If you’re still processing invoices manually, approving payments via email chains, or chasing suppliers for missing paperwork, you’re essentially running your Accounts Payable (AP) like it’s 1999. That inefficiency doesn’t just slow your team—it costs you in overpayments, missed early payment discounts, and damaged supplier relationships.

The solution? Accounts payable automation tools—but not all software is created equal. Pick the wrong one, and you’ll just digitize your existing inefficiencies. Pick the right one, and you can cut processing times by 60%, eliminate most manual errors, and gain complete control over cash flow.

This guide walks you through the must-have features in AP automation tools so you can invest in a platform that delivers measurable ROI—not just a shinier version of your current process.

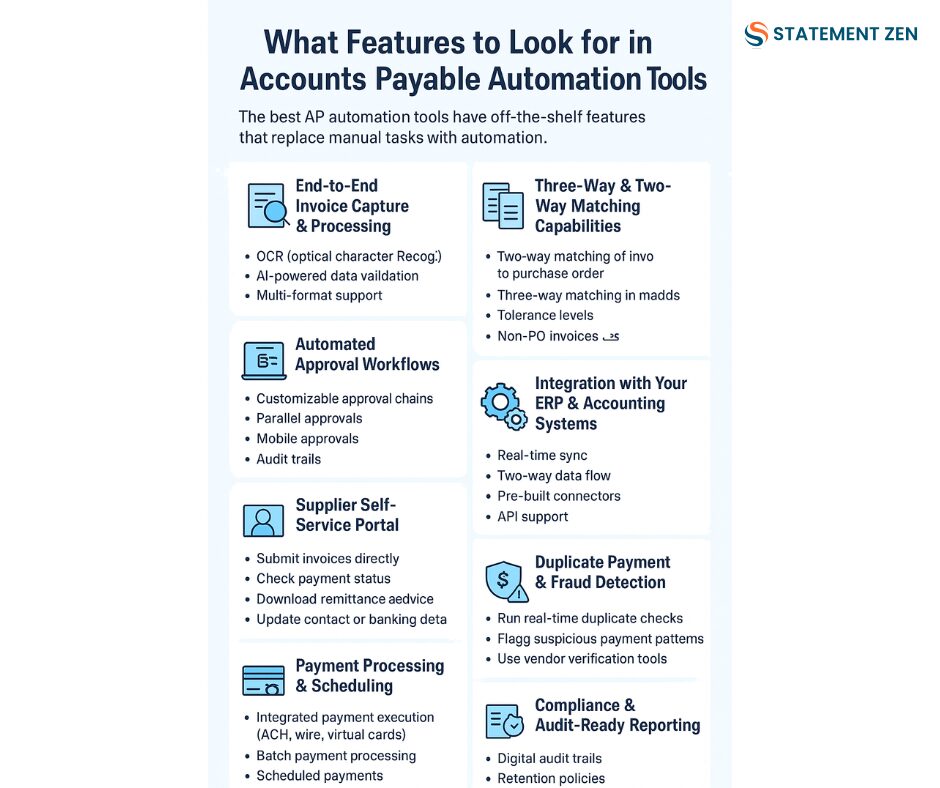

1. End-to-End Invoice Capture & Processing

The best AP automation tools start by eliminating manual data entry. Look for:

- OCR (Optical Character Recognition): Automatically reads and extracts invoice data from PDFs, scans, and even emailed invoices.

- AI-powered data validation: Flags missing fields, mismatched purchase order numbers, or duplicate invoices before they enter your ERP.

- Multi-format support: Handles PDFs, Word docs, image files, and EDI invoices.

Pro Tip: OCR without AI validation is like having a scanner that reads but doesn’t understand. You want both.

2. Three-Way & Two-Way Matching Capabilities

Invoice matching isn’t just an “extra”—it’s your frontline defense against overpayments and fraud. Your AP automation tool should:

- Two-way match invoices to purchase orders (POs)

- Three-way match invoices, POs, and goods receipts for higher accuracy

- Allow tolerance levels (e.g., flagging price variances above 2%)

- Handle non-PO invoices with proper approval workflows

Example: A supplier invoices you for 1,050 units when the PO was for 1,000. A smart matching system flags the 50-unit discrepancy instantly—saving you thousands over time.

(https://statementzen.com/how-it-works/How It Works → AP workflow automation)

3. Automated Approval Workflows

AP bottlenecks often happen at the approval stage. Features to demand:

- Customizable approval chains based on amount, department, or supplier

- Parallel approvals to avoid delays when multiple sign-offs are needed

- Mobile approvals so managers can approve invoices from anywhere

- Audit trails for every approval or change made

This turns what used to be a five-day approval loop into a same-day process—a big win for both cash flow and supplier satisfaction.

4. Integration with Your ERP & Accounting Systems

An AP automation tool that doesn’t integrate cleanly with your ERP is like buying a sports car with no fuel tank.

Key integration capabilities:

- Real-time sync with ERP data (vendors, GL codes, POs)

- Two-way data flow (changes made in AP tool update ERP and vice versa)

- Pre-built connectors for popular ERPs like Xero, QuickBooks, NetSuite, and SAP

- API support for custom integration

(Internal link: Features → AP automation features)

5. Supplier Self-Service Portal

You shouldn’t be your suppliers’ customer service hotline. A self-service portal allows vendors to:

- Submit invoices directly

- Check payment status in real time

- Download remittance advice

- Update their own contact or banking details (with approval)

Result? Fewer supplier emails, less back-and-forth, and more time for strategic AP work.

6. Duplicate Payment & Fraud Detection

Fraudulent or duplicate invoices are not as rare as you might think. Your AP automation tool should:

- Run real-time duplicate checks across all historical invoices

- Flag suspicious payment patterns

- Use vendor verification tools to confirm bank account legitimacy before payments are sent

This alone can prevent tens—or even hundreds—of thousands in losses annually.

7. Payment Processing & Scheduling

End-to-end AP automation doesn’t stop at invoice approval. Look for:

- Integrated payment execution (ACH, wire, virtual cards)

- Batch payment processing for efficiency

- Scheduled payments to optimize cash flow and capture early-payment discounts

- Multi-currency support if you work with global suppliers

8. Compliance & Audit-Ready Reporting

Audits become a nightmare when your records are scattered across spreadsheets, email attachments, and filing cabinets.

Your AP automation software should offer:

- Digital audit trails for every transaction

- Retention policies that align with your compliance requirements

- Configurable reporting for AP aging, supplier spend, and approval performance

- Export to multiple formats for external auditors

When compliance is baked into the system, you’re always audit-ready—no scrambling.

9. Analytics & Performance Dashboards

You can’t improve what you can’t measure. The right AP automation tool will track:

- Invoice processing times by department or approver

- Percentage of invoices processed straight-through without human touch

- Supplier performance metrics (on-time delivery, dispute frequency)

- Cost savings from early-payment discounts or duplicate prevention

Dashboards give you real-time visibility into the health of your AP process.

10. Scalability & Future-Proofing

Finally, think beyond today’s needs. You want a solution that will still serve you when invoice volume doubles or your business expands internationally.

Consider:

- Cloud-based architecture for scalability

- Role-based access controls for security as teams grow

- Machine learning capabilities that improve matching and fraud detection over time

- Customizable modules so you can add functionality without switching platforms

Case Example: The ROI of the Right AP Automation Tool

A mid-sized manufacturing company processing 8,000 invoices a month switched from manual AP to a full-featured automation platform with OCR, 3-way matching, and supplier portals.

Results after 6 months:

- Invoice cycle time reduced from 12 days to 3 days

- Duplicate payments dropped to zero

- Saved $65,000 through early-payment discounts

- Freed up 1.5 FTEs for higher-value finance projects

Don’t Just Automate—Optimize

Accounts payable automation tools can either streamline your workflow or simply digitize your inefficiencies. The difference comes down to the features you choose.

Look for:

- End-to-end automation (from invoice capture to payment)

- Strong ERP integration

- Intelligent matching and approval workflows

- Supplier self-service and fraud prevention

- Scalable, analytics-driven architecture

Invest wisely now, and your AP department could transform from a cost center into a strategic driver of cash flow and supplier relationships.

Next Step: Explore our AP automation features or see exactly how our AP workflow automation works in a live demo.