The Problem With Choosing the Wrong Supplier Statement Matching Solution

Your AP team already knows the value of supplier statement matching — it’s the safety net that catches missing invoices, unclaimed credits, and duplicate payments before they impact cash flow.

But here’s the trap: Not all supplier statement matching solutions are created equal.

Choose the wrong one, and you’ll still be stuck:

- Manually re-keying statement data from PDFs.

- Spending hours chasing exceptions without resolution.

- Missing credits worth thousands because your system can’t process certain formats.

In other words, the wrong tool doesn’t just waste your team’s time — it erodes the ROI you expected from automation. Moreover, using ineffective tools can lead to frustration and decreased morale among team members, ultimately impacting overall productivity. To counteract this, it’s essential to invest in solutions that truly align with your objectives, much like the way home organization tips and tricks can transform your living space into a more efficient and enjoyable environment. By choosing the right tools, you not only save time but also enhance the value of your automation efforts.

This article breaks down the key differences between solutions so you can make a confident choice.

What Is Supplier Statement Matching?

Before comparing tools, let’s clarify the process:

Supplier statement matching involves comparing the supplier’s statement of account against your AP records to:

- Identify missing invoices — items on the supplier statement that are not in your ERP.

- Detect unclaimed credits — credit notes not applied in your system.

- Prevent duplicate payments — invoices already paid that appear again.

- Flag discrepancies in amounts or dates that require investigation.

An effective solution turns what used to be hours of manual checking into a quick, automated process — ideally fully integrated with your AP workflow.

The Key Comparison Factors

When evaluating supplier statement matching software, consider these critical dimensions:

1. Automation Level

- Basic Tools: Require manual statement uploads and partial data entry.

- Advanced Tools: Offer automatic statement ingestion from email inboxes, supplier portals, or APIs.

Pro tip: The more automated the data ingestion, the lower the risk of human error.

2. Format Flexibility

- Basic: Handle standard PDF statements only.

- Advanced: Accept PDFs, scanned documents, CSV, XLSX, and even EDI feeds.

The best tools process both structured and unstructured formats using OCR + AI to handle inconsistent supplier templates.

3. Matching Intelligence

- Basic: Match on invoice number and date only.

- Advanced: Use multi-criteria matching (invoice number, PO number, date, amount, supplier code) plus fuzzy logic for typos or format variations.

Advanced matching significantly increases match rates and reduces exceptions.

4. Exception Management

- Basic: Produce static exception reports for manual follow-up.

- Advanced: Provide in-platform workflows — assign exceptions, add notes, request documents from suppliers, and track resolution status.

If your team spends hours in Excel following up on mismatches, you need built-in resolution workflows.

5. Integration Capability

- Basic: Export CSV for manual ERP upload.

- Advanced: Seamless two-way sync with ERP and AP automation platforms, pushing cleared matches and flagged exceptions directly into your workflow.

This is critical for real-time discrepancy resolution.

6. Analytics & Reporting

- Basic: Simple mismatch counts.

- Advanced: Vendor performance tracking, recurring issue detection, and trend analysis.

Analytics help you identify suppliers who consistently send late or error-prone statements.

7. Scalability

- Basic: Work for small volumes (under 100 suppliers).

- Advanced: Handle thousands of suppliers and statements per month without slowing down.

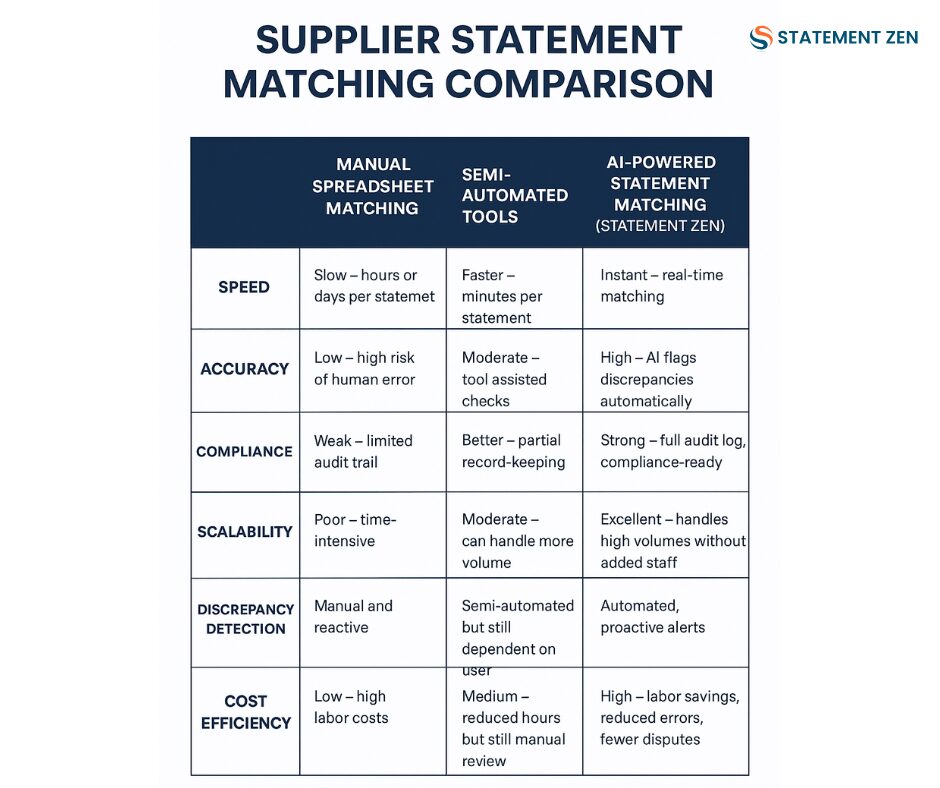

Side-by-Side: Manual vs. Automated vs. Intelligent Matching

| Feature | Manual Process | Automated Matching | Intelligent Matching |

|---|---|---|---|

| Statement capture | Email/download manually | Auto-upload from inbox | Auto-fetch from portals + inbox |

| Format handling | PDF only | PDF + CSV | PDF + CSV + OCR for scans |

| Match logic | Invoice # only | Invoice # + date | Multi-criteria + fuzzy logic |

| Exception handling | Excel follow-up | Report generation | In-app resolution workflows |

| ERP integration | None | CSV export | Real-time sync |

| Analytics | None | Basic counts | Vendor performance insights |

Real-World ROI Examples

A UK-based retail chain switched from semi-manual matching to an advanced AI-powered platform:

- Recovered £62,000 in missed credits in the first 6 months.

- Reduced statement reconciliation time from 4 days to under 4 hours.

- Identified recurring supplier errors that led to process improvements.

A manufacturing group handling 1,200 suppliers implemented intelligent matching:

- Automated ingestion from 20+ supplier portals.

- Cut exceptions by 55% through fuzzy matching and tolerance rules.

- Increased early payment discounts captured by 18%.

The Hidden Cost of “Cheap” Tools

It’s tempting to choose a budget-friendly solution, but here’s the issue:

- Low match rates mean your AP team still spends hours manually reconciling.

- Limited format support forces suppliers to adapt — which rarely happens.

- No workflow means exceptions still pile up in email inboxes.

When you factor in labor hours, lost credits, and duplicate payments, the “cheaper” tool often costs more than a premium solution.

Compliance & Audit Advantages

Advanced supplier statement matching doesn’t just save money — it protects you during audits:

- Full time-stamped audit trails for every match and exception.

- Easy export of reconciliation reports for SOX compliance.

- Reduction in fraud risk through proactive duplicate detection.

How Statement Zen Stands Out

Statement Zen’s Supplier Statement Verification module offers:

- Multi-format ingestion — PDF, scanned docs, CSV, and portal integration.

- AI-powered matching with fuzzy logic and multi-criteria comparison.

- Real-time ERP integration for instant updates.

- Built-in resolution workflows to close exceptions faster.

- Vendor analytics to track statement accuracy and timeliness.

See our supplier statement matching features →

[Learn how our expertise ensures unmatched reconciliation accuracy . Our team leverages advanced supplier evaluation techniques to streamline the reconciliation process, ensuring that discrepancies are identified and addressed promptly. By integrating these methods into our workflow, we enhance overall accuracy and efficiency, building stronger relationships with our suppliers. Trust in our proven systems to deliver reliable results that drive your business forward.

Choosing the Right Tool: The 3-Step Method

- List Your Must-Haves

Include integration needs, statement volumes, and compliance requirements. - Score Vendors Against Key Criteria

Use the comparison factors above to evaluate objectively. - Pilot Before Committing

Run 30 days of statements through the tool to test match rates, workflows, and time savings.

Final Word

Supplier statement matching isn’t optional — but choosing the right solution determines whether it’s a true AP asset or just another admin chore.

Invest in intelligent, automated matching, and you’ll:

- Recover missed credits faster.

- Prevent overpayments before they happen.

- Free up AP staff to focus on supplier relationships, not data entry.

FAQ

Q: How do I know if my current process is underperforming?

If match rates are below 90% or you’re still manually keying statement data, you’re leaving efficiency on the table.

Q: Can I run supplier statement matching for only my top suppliers?

Yes, but you’ll miss savings from smaller vendors who often have more invoicing errors.

Q: What’s the average payback period for automated matching software?

Most organizations see ROI within 3–6 months from recovered credits and reduced labor costs.