When it comes to accounts payable (AP), a sloppy statement audit is like leaving your vault door wide open. You might be fine for a while — but eventually, money will slip away, and you won’t notice until it’s gone.

Payment errors don’t just drain cash. They erode supplier trust, delay reporting, and make your finance team scramble every month-end. The truth is, a well-run statement audit process isn’t just about catching mistakes — it’s about building a bulletproof AP system that prevents them in the first place.

In this guide, you’ll learn proven best practices for conducting statement audits that not only detect errors but also keep your AP process lean, accurate, and audit-ready year-round.

What Is a Statement Audit?

A statement audit is the process of verifying every transaction — invoices, credit notes, and payments — listed on a supplier’s statement against your AP records.

Unlike ledger-level reconciliation, which checks only if balances match, a statement audit digs into the “why” behind the numbers. You’re confirming that:

- Every supplier invoice is recorded in your AP system

- All supplier credits are applied correctly and on time

- Payments in your ledger match exactly with the supplier’s records

- Discrepancies are flagged, investigated, and resolved

💡 Internal Resource: Learn more about the [statement audit process](Features page link) we’ve built into Statement Zen for accuracy at scale.

Why Payment Errors Happen in the First Place

Even the most experienced AP teams get tripped up by:

- Volume pressure: Large suppliers send hundreds of invoices each month.

- Human error: Manual entry mistakes are inevitable, especially under time crunch.

- Complex credits: Discounts, returns, and rebates often go unclaimed.

- Duplicate invoices: Different invoice numbers, same transaction.

- Mismatched timing: Supplier sends an invoice late; AP books it in a different month.

A statement audit acts like a high-powered magnifying glass, catching these problems before they snowball into costly write-offs or supplier disputes.

The ROI of Doing It Right

It’s not just about “checking the box.” Done right, a statement audit:

- Protects cash flow: Every unapplied credit reclaimed is money straight back into the business.

- Prevents overpayments: Stops duplicate invoices from slipping through.

- Boosts supplier relationships: Resolving discrepancies quickly shows professionalism.

- Speeds up audits: Complete and accurate records mean less back-and-forth with auditors.

- Supports compliance: Consistent processes keep you aligned with internal controls and external regulations.

For example, one Statement Zen client found $87,000 in unclaimed credits within the first 90 days of switching from manual to automated statement audits.

Statement Audit Best Practices

Here’s the blueprint we use when consulting with AP leaders and implementing our software.

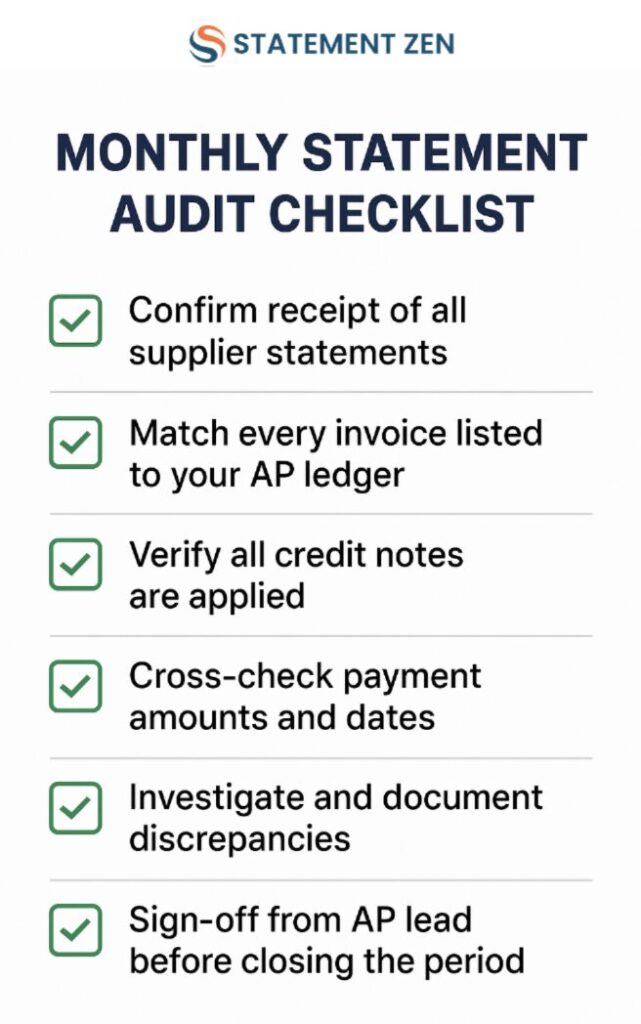

1. Standardize Your Process with a Monthly Audit Checklist

A checklist is your first line of defense. Without it, AP reviews are inconsistent — and important checks get skipped when the team is busy.

Your monthly statement audit checklist should include:

- Confirm receipt of all supplier statements for the period.

- Match every invoice listed to your AP ledger.

- Verify all credit notes are applied.

- Cross-check payment amounts and dates.

- Investigate and document discrepancies.

- Sign-off from AP lead before closing the period.

Having a documented workflow also acts as your training manual for new AP staff. It’s not just about what to check — but why it matters.

2. Separate Balance Checks from Transaction Audits

Too many teams confuse reconciliation with a full statement audit. Here’s the danger:

- Balance check: “We owe $45,000, supplier says $45,000 — done.”

- Statement audit: “We owe $45,000, but $2,000 of that is a duplicate invoice.”

Always run both processes. The balance check gives you a quick snapshot; the transaction audit uncovers the real issues.

3. Prioritize High-Risk Suppliers

Not all suppliers are equal in audit priority. Focus on those with:

- High transaction volumes

- Complex credit arrangements

- Frequent discrepancies in past audits

- Significant spend (top 20% of your AP outflow)

This targeted approach ensures you’re putting resources where they matter most.

4. Automate the Matching Process

Manual matching is slow, error-prone, and hard to scale. Modern [supplier statement matching](Features page link) tools can:

- Import supplier statements directly

- Match line items against your AP ledger in seconds

- Highlight discrepancies automatically

- Create a complete audit trail for compliance

Automation doesn’t just make the process faster — it also gives you real-time visibility into errors, so you can fix them before month-end chaos sets in.

5. Document Every Exception and Resolution

A missed or unresolved discrepancy is a ticking time bomb.

Your statement audit log should record:

- Supplier name

- Nature of the discrepancy

- Date identified

- Resolution details

- Person responsible

This creates accountability, speeds up follow-ups, and protects your team in case of future disputes.

6. Close the Feedback Loop with Root Cause Analysis

Finding the same errors month after month? That’s a sign of a systemic problem — not just bad luck.

Examples:

- Frequent duplicate invoices from one supplier → educate supplier AP team.

- Regular unapplied credits → update internal credit application process.

- Late invoice submissions → negotiate revised terms with suppliers.

A statement audit isn’t “done” when the numbers match. It’s done when the causes of discrepancies are eliminated.

Common Mistakes to Avoid

Even experienced teams fall into these traps:

- Only doing balance checks → misses hidden transaction errors.

- Not auditing regularly → discrepancies compound over months.

- Skipping documentation → no paper trail for disputes or audits.

- Treating automation as ‘set and forget’ → technology still needs oversight.

The Role of Automation in Modern Statement Audits

The old way: Print statements, mark them up with a highlighter, and key in changes.

The new way: Automated statement matching software pulls in data, flags mismatches, and generates reports instantly.

With [audit expertise](About Us page link) built into Statement Zen, AP teams can handle 10x more statements in the same time — with fewer errors, less stress, and full audit readiness.

FAQ: Statement Audits

Q: How often should I perform statement audits?

A: For most companies, monthly is ideal. High-volume suppliers may need weekly checks.

Q: Do I still need to audit if I run automated matching?

A: Yes — automation speeds the process, but human review ensures accuracy and context.

Q: Can small AP teams benefit from statement audits?

A: Absolutely. Even small overpayments or missed credits can add up quickly.

Final Thoughts

A statement audit is more than a financial hygiene task — it’s a profit protection tool. Done right, it safeguards cash flow, prevents disputes, and keeps your AP process watertight.

With a clear checklist, risk-based priorities, and modern automation, your AP team can stop playing “catch-up” and start running proactive, error-proof statement audits.

If you want to see how our clients are eliminating payment errors and reclaiming missed credits with automated statement matching, check out our product here!