The Problem With Manual Accounts Payable

If your accounts payable (AP) team is buried under piles of invoices, manually checking line items, and chasing down payment approvals, you’re not alone.

Most AP departments waste 30–40% of their time on manual data entry, duplicate payment prevention, and chasing suppliers for missing invoices.

Manual AP processes lead to:

- Late payments that harm supplier relationships.

- Duplicate or incorrect payments that drain cash flow.

- Slow month-end closes that stall financial reporting.

- Compliance risks due to inconsistent record-keeping.

And here’s the kicker: the longer you wait to automate, the more expensive your inefficiencies become.

Why Automate Accounts Payable?

AP automation is not just a tech upgrade — it’s a cash flow control system.

With the right tools, you can:

- Cut invoice processing time by up to 80%.

- Reduce payment errors by 90%.

- Get real-time visibility into AP liabilities.

- Eliminate supplier disputes before they reach escalation.

- Strengthen compliance with an auditable workflow.

Automation replaces repetitive, error-prone manual work with software that reads invoices, matches them to purchase orders, verifies details, and pushes them through approval flows automatically.

The Core Components of AP Automation

To understand how to automate accounts payable, you need to break it into its four core pillars.

1. Invoice Capture

- Use OCR (Optical Character Recognition) and AI-based data extraction to read invoice data from PDFs, images, and emails.

- Automatically populate fields such as supplier name, invoice date, PO number, and line items.

- Pro tip: Choose a tool that integrates directly with your ERP or accounting software to avoid double entry.

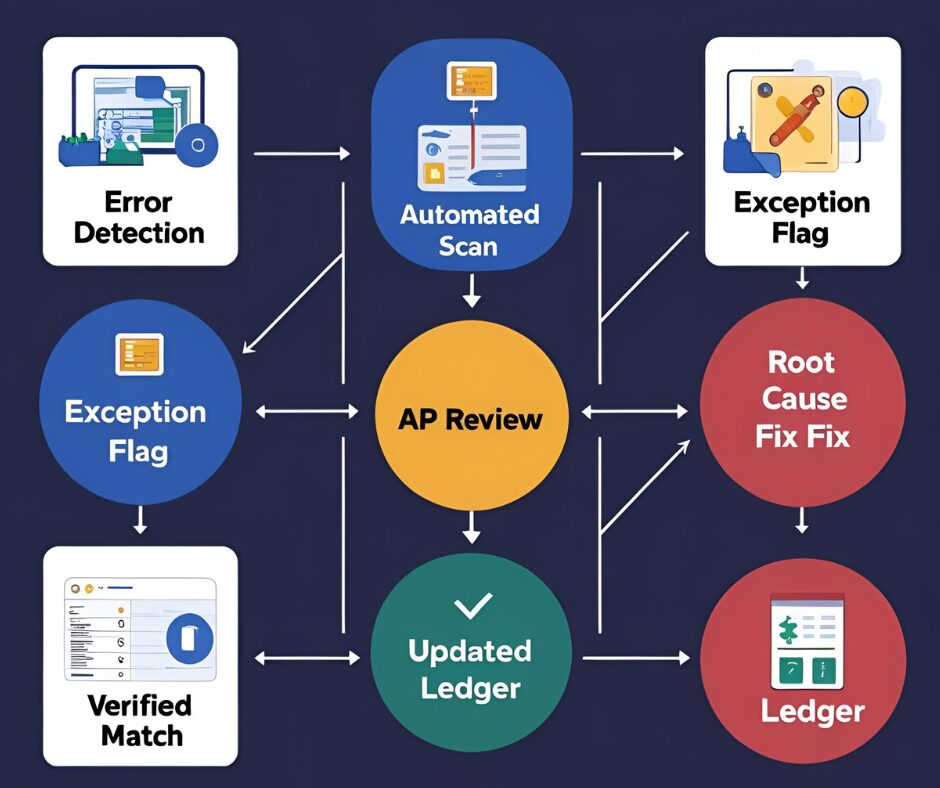

2. Automated Matching

- Match invoices against purchase orders (PO matching) and supplier statements (statement matching) in real-time.

- Flag mismatches — like incorrect quantities, prices, or tax rates — for review.

- Related feature: Statement Zen’s AP matching workflow instantly identifies discrepancies so you can resolve them before they delay payment.

3. Approval Workflow Automation

- Route invoices automatically to the right approver based on amount, department, or project code.

- Use mobile approvals for faster sign-off.

- Maintain an auditable trail for compliance purposes.

4. Payment Automation

- Schedule and batch payments to optimize cash flow.

- Use secure payment rails (ACH, EFT, virtual cards) to reduce fraud risk.

- Sync payment confirmations back to your accounting system.

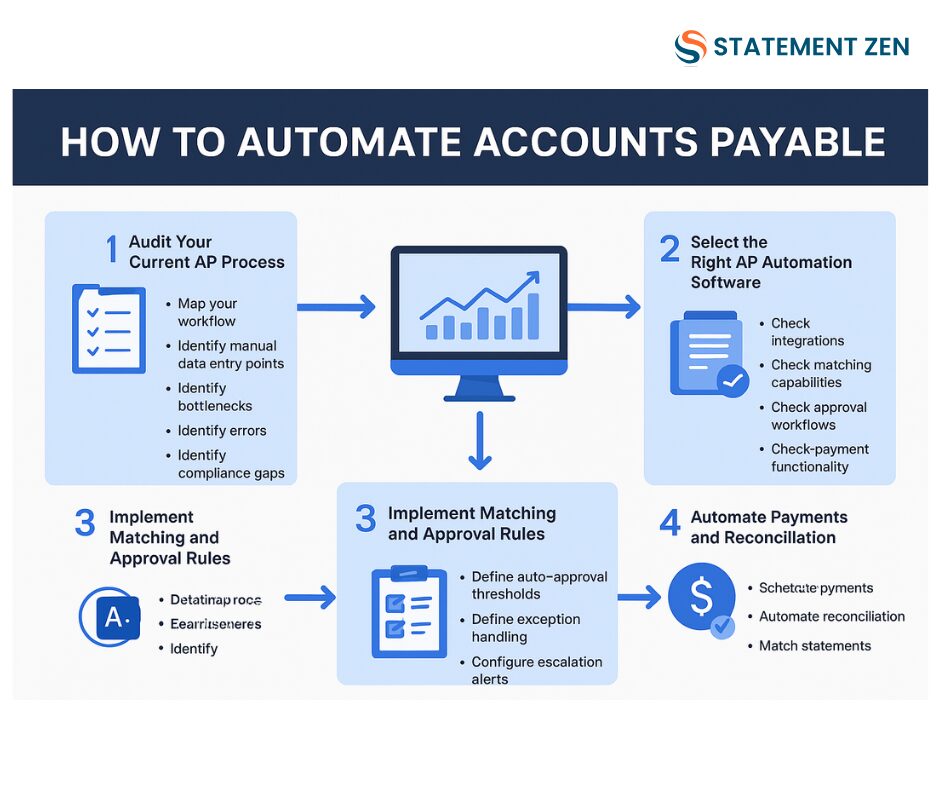

Step-by-Step: How to Automate Accounts Payable in Your Business

Step 1: Audit Your Current AP Process

Map your workflow from invoice receipt to payment. Identify:

- Manual data entry points

- Common bottlenecks (e.g., delayed approvals)

- Frequent errors or disputes

- Compliance gaps

Step 2: Select the Right AP Automation Software

Look for:

- Integration with your existing ERP/accounting system

- Multi-method invoice capture (email, scan, upload)

- 2-way/3-way matching capabilities

- Customizable approval routing

- Built-in compliance and audit reporting

(For example, Statement Zen’s statement audit tools combine invoice and statement matching with supplier verification for a complete AP control solution.)

Step 3: Digitize Supplier Communications

Ask suppliers to send invoices and statements electronically. This allows automation software to capture and process them instantly.

Step 4: Implement Matching and Approval Rules

- Define thresholds for auto-approval (e.g., <$500, matched to PO).

- Set exception handling paths for discrepancies.

- Configure escalation alerts for overdue approvals.

Step 5: Automate Payments and Reconciliation

- Schedule payments based on due dates and cash flow priorities.

- Auto-mark paid invoices as reconciled in your system.

- Match supplier statements monthly to catch missed or duplicate payments.

Real-World Example: Before and After AP Automation

Before Automation

A construction firm’s AP team spent 25 hours a week manually entering invoices from 40+ suppliers. Month-end close took 10+ days, and duplicate payments occurred every quarter, costing thousands.

After Automation with Statement Zen

- Invoice processing time dropped by 78%.

- Month-end close cut from 10 days to 3 days.

- Duplicate payments eliminated entirely.

- AP staff reallocated 15 hours/week to vendor relationship management.

Common Mistakes to Avoid When Automating AP

- Skipping Supplier Statement Matching

Automating invoice processing without matching to supplier statements leaves you exposed to missing invoices and unclaimed credits. - Not Integrating With Your ERP

If your AP tool doesn’t sync with your ERP, you’re stuck with manual imports — defeating the purpose of automation. - Overcomplicating Approval Rules

Complex routing slows things down. Start simple and refine later. - Ignoring Change Management

Automation is as much about people as tech. Train your AP team and suppliers on the new process.

The ROI of Accounts Payable Automation

| Metric | Before Automation | After Automation |

|---|---|---|

| Invoice Processing Time | 12 min/invoice | 2.5 min/invoice |

| Duplicate Payment Rate | 1.5% | 0% |

| Month-End Close Duration | 10 days | 3 days |

| AP Staff Hours on Data Entry | 20 hrs/week | 4 hrs/week |

FAQs About Automating Accounts Payable

Q: Can small businesses benefit from AP automation?

Absolutely. Even with a small invoice volume, automation prevents costly mistakes and frees up time for growth-focused tasks.

Q: How long does it take to implement?

Most systems can be live in 2–6 weeks, depending on ERP integration and approval complexity.

Q: Is it expensive?

Modern AP automation tools are subscription-based and can often pay for themselves in recovered duplicate payments and labor savings within months.

Final Thoughts

Learning how to automate accounts payable isn’t about replacing people — it’s about freeing them from tedious, error-prone work so they can focus on higher-value tasks.

By combining invoice capture, supplier statement matching, automated approvals, and payment scheduling, you’ll create an AP process that’s faster, more accurate, and far more compliant.

If you’re ready to move beyond manual processes and gain total visibility into your AP workflow, explore how Statement Zen’s AP matching workflow can transform your department.