If you’re running a large Accounts Payable (AP) operation, statement reconciliation isn’t just a box to tick at month-end — it’s a strategic safeguard for your organization’s cash flow, compliance, and supplier relationships. Done well, it can prevent costly errors, speed up your month-end close, and free your team from tedious manual checks. Done poorly, it can quietly drain hundreds of thousands from your bottom line every year.

The difference between the two outcomes? Your process.

In this guide, we’ll walk through statement reconciliation best practices that are built for large AP teams, showing you how to evolve from manual, error-prone workflows into a streamlined, automated engine that delivers accuracy and speed at scale.

Why Statement Reconciliation Matters More for Large AP Teams

When your AP department processes thousands of supplier invoices every month, the stakes multiply. Each reconciliation isn’t just about “making sure the numbers add up” — it’s about protecting your organization from compounding risks:

- Duplicate payments that eat into cash flow.

- Unapplied credits that remain hidden until they expire.

- Incorrect balances that misstate liabilities on your books.

- Supplier disputes that strain relationships and cause operational delays.

A small business might catch these issues with an ad-hoc review. Large AP teams don’t have that luxury. The volume and complexity of transactions mean that reconciliation must be systematic, documented, and consistent — or you risk chaos at scale.

The Two Layers of Statement Reconciliation

Before we get into best practices, it’s important to separate ledger-level reconciliation from transaction-level statement matching:

- Ledger-Level Reconciliation

- Compares the total AP ledger balance to the supplier’s statement balance.

- Focused on the “big number,” not individual transactions.

- Example: If both sides show $450,000 owed, the ledger-level reconciliation is complete — even if invoice-level differences still exist.

- Transaction-Level Statement Matching

- Goes line-by-line to match invoices, credits, and payments.

- Detects missing invoices, unapplied credits, and duplicates.

- Ensures the ledger and the supplier’s records align perfectly.

Large AP teams need both. Ledger-level checks give you high-level confidence; statement matching ensures no costly discrepancies are hiding in the details.

Best Practices for Manual Statement Reconciliation (If You’re Still There)

Even if your team is still operating manually, you can reduce risk and save time by standardizing your process:

- Centralize Statement Collection

Route all supplier statements to a single monitored inbox or portal. - Use a Standardized Checklist

Every supplier, every time — no exceptions. This eliminates “I thought someone else checked that” errors. - Prioritize High-Value Suppliers

If time is short, start with the suppliers that represent the largest spend or highest risk. - Document Exceptions

Log every discrepancy found, the root cause, and how it was resolved. This builds a usable audit trail and improves future prevention. - Enforce Cut-Off Dates

Agree with suppliers on statement and payment cut-offs to avoid timing mismatches.

While these steps help, manual processes will always be slower, more error-prone, and more expensive than automation.

Moving to Automation: The Real Game Changer

Manual reconciliation is like fighting with one hand tied behind your back. Automated reconciliation — using AP software like Statement Zen’s supplier matching tools — changes the game by:

- Ingesting statements automatically from email, portals, or EDI feeds.

- Scanning line-by-line for mismatches, missing invoices, and unapplied credits in seconds.

- Flagging exceptions instantly so your AP team only works on the problem items.

- Creating a full audit trail without extra admin work.

In large AP teams, automation isn’t just about speed — it’s about risk reduction and scalability.

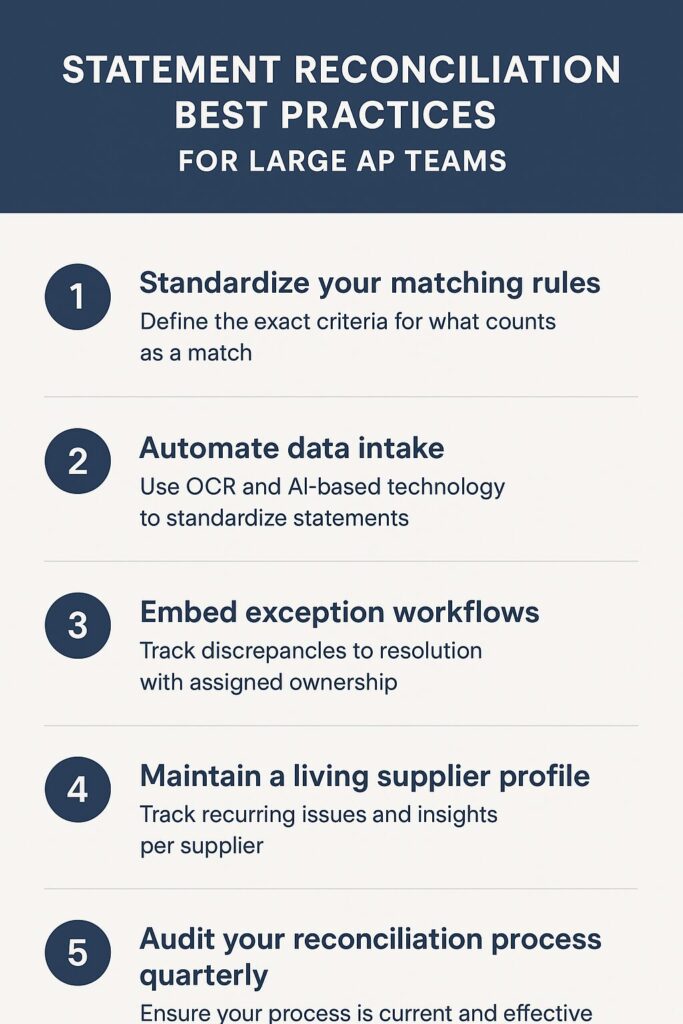

Statement Reconciliation Best Practices for Large AP Teams

Here’s the blueprint for running reconciliation like a high-performing AP operation:

1. Standardize Your Matching Rules

Define the exact criteria for what counts as a match:

- Invoice number, PO number, amount, and date tolerances.

- Clear guidelines for handling partial payments or multiple credits.

This ensures your automation platform is enforcing your rules, not guessing them.

2. Automate Data Intake

Don’t rely on suppliers sending statements in neat, consistent formats. Use OCR and AI-based ingestion to standardize them for comparison. The less manual formatting your team does, the faster and more accurate reconciliation will be.

3. Embed Exception Workflows

When discrepancies arise, they should move straight into a tracked resolution process — not sit in someone’s inbox. Assign ownership, track progress, and close the loop.

4. Maintain a Living Supplier Profile

Track recurring issues per supplier: late invoices, frequent credits, data format problems. This allows your team to have informed discussions with suppliers and improve upstream processes.

(Internal link to supplier matching insights here.)

5. Audit Your Reconciliation Process Quarterly

Even automation can drift if rules aren’t updated. Quarterly reviews ensure:

- Matching tolerances still reflect business policy.

- Supplier data is current.

- Exception types are trending down, not up.

ROI of Automating Statement Reconciliation

For large AP teams, the ROI isn’t hypothetical — it’s measurable:

- Time Saved: If automation cuts 200 staff hours per month at $30/hour, that’s $6,000 saved monthly.

- Error Prevention: Eliminating $100k/year in duplicate payments is pure margin recovery.

- Early Payment Discounts: Faster reconciliation frees invoices for approval in time to secure discounts worth tens of thousands.

- Audit Cost Reduction: Pre-built audit trails slash prep time and external auditor fees.

(Internal link to [statement reconciliation](About Us) here.)

Common Pitfalls to Avoid

- Automating a Broken Process: If your current rules are unclear or inconsistent, automation will just make bad results faster.

- Ignoring Exception Trends: If the same type of mismatch keeps recurring, fix the root cause, not just the symptom.

- Failing to Train Staff: Automation frees time, but staff must be retrained to focus on higher-value tasks like vendor negotiations or fraud prevention.

Final Word: Best Practices Are Only “Best” if They’re Followed

A well-designed reconciliation process is like a guardrail — it doesn’t slow you down, it keeps you from going off a cliff. For large AP teams, combining disciplined process design with automation technology turns reconciliation from a time drain into a strategic advantage.

The companies that win here aren’t just saving time; they’re reducing financial risk, improving supplier trust, and giving leadership cleaner data to make better decisions.

If you’re ready to see what a modern reconciliation process looks like in action — with automation, exception workflows, and supplier insights built in — Statement Zen can help.