If your accounts payable team is still doing statement matching with spreadsheets, you’re leaving money on the table. Every duplicate payment, unapplied credit, or month-end reconciliation delay eats away at cash flow and trust with suppliers. And the truth is, manual processes are not just slow—they’re inherently prone to error.

That’s why forward-thinking finance leaders are turning to an automated statement matching process—a smarter, faster, and more accurate way to reconcile supplier statements and AP ledgers. In this guide, we’ll walk you through why automation isn’t just an upgrade—it’s a competitive necessity.

Why Statement Matching Is the Backbone of AP Accuracy

At its core, statement matching is about ensuring that your supplier’s version of what you owe matches your own accounts payable records. It’s a simple concept, but without it, you risk:

- Paying invoices twice because no one cross-checked the statement.

- Missing supplier credits that could have reduced your liabilities.

- Spending hours in back-and-forth disputes with vendors over discrepancies.

- Starting month-end close with incomplete or inaccurate balances.

In other words, skipping or rushing the process is like signing a blank check—your cash is going out, but you don’t know exactly where or why.

The Manual Matching Reality: Slow, Error-Prone, and Costly

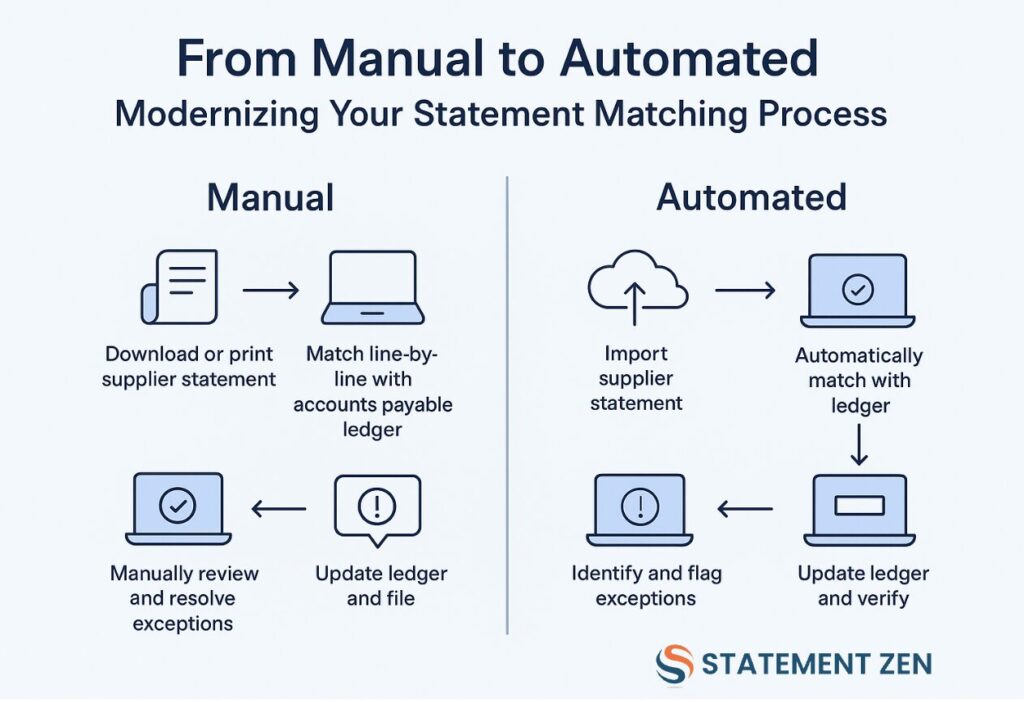

In a manual setup, your AP team receives a supplier statement, downloads or prints it, and then line-by-line compares it to your ledger. That might be manageable for one supplier. But when you have hundreds—each with their own formats, invoice numbering quirks, and cut-off dates—the workload quickly snowballs.

Common pitfalls include:

- Human error: Typos, skipped lines, or misread amounts.

- Delayed detection: Discrepancies only found weeks later, making them harder to resolve.

- Inconsistent processes: Different staff apply different levels of rigor, leading to gaps in checks.

- Lost audit trails: Key reconciliation steps aren’t documented consistently.

The result? Month-end close drags on, your AP team works late, and your CFO is still chasing numbers while the board wants results.

What an Automated Statement Matching Process Looks Like

Switching to an automated statement matching process isn’t just about replacing manual work with software—it’s about building a repeatable, real-time control system that strengthens every part of your AP function. By implementing this innovative approach, organizations can significantly reduce errors and streamline their reconciliation efforts. The statement matching software benefits extend beyond mere efficiency; they also enhance compliance and audit readiness, providing stakeholders with greater confidence in financial reporting. Ultimately, such a system fosters a more agile and responsive accounts payable department, capable of adapting to evolving business needs.

Here’s how a modern setup typically works:

- Statement Ingestion

Supplier statements arrive (email, portal, EDI) and are automatically imported into your supplier reconciliation software—no printing, no manual file uploads. - Automated Matching Engine

The system compares every invoice, credit note, and payment line from the statement to your AP ledger in seconds. Matching criteria can be configured for your business rules (invoice number, date, amount, PO match). - Exception Detection & Flagging

Discrepancies—like missing invoices, unapplied credits, or duplicate entries—are flagged instantly for AP review. - AP Review & Resolution

Instead of hunting for problems, your team focuses only on the exceptions, working directly within the AP matching automation workflow. - Ledger Update & Verification

Once resolved, the ledger is updated, and the statement is marked as fully reconciled. You now have a clean, auditable record.

The ROI of Automating AP Matching

If you want buy-in from leadership, you can’t just say “it feels faster”—you need to show a clear financial case. Here’s a simple framework:

1. Time Saved

Measure hours spent on manual matching before and after automation. Multiply by your AP staff’s hourly cost.

Example: Saving 200 staff hours/month at $25/hr = $5,000 saved monthly.

2. Errors Prevented

Track duplicate payments avoided and value of recovered supplier credits.

Example: Eliminating $50,000/year in duplicate payments = pure ROI.

3. Early Payment Discounts

Faster matching means invoices get approved sooner, unlocking early payment discounts that were previously missed.

4. Audit Cost Reduction

Cleaner records mean shorter audit prep and fewer billable hours from external auditors.

Why Supplier Reconciliation Software Changes the Game

Supplier reconciliation software isn’t just about speed—it’s about visibility. With automation, you can see:

- Real-time status of every supplier’s reconciliation.

- Trend data on recurring discrepancies.

- Performance metrics for supplier accuracy over time.

This data transforms AP from a reactive back-office function into a proactive partner in cash management and supplier relationship building.

Real-World Example: From 10 Days to 2 Days

One Statement Zen client—an AP team handling over 500 supplier statements monthly—reduced their month-end reconciliation time from 10 days to just 2 days. By automating their statement matching:

- Duplicate payments dropped to near zero.

- They recovered over $80,000 in missed credits in the first year.

- Supplier disputes decreased by 60%, freeing AP staff to focus on value-add work.

Transitioning from Manual to Automated: Best Practices

If you’re ready to modernize your statement matching, follow these steps for a smooth rollout:

- Map Your Current Process

Document exactly how statements are received, matched, and approved today. Identify bottlenecks and failure points. - Select the Right Software

Look for a platform that integrates with your ERP, supports multi-format statements, and offers configurable matching rules. - Start with a Pilot

Choose a subset of suppliers to run through the new automated workflow before full rollout. - Train Your Team

Ensure AP staff understand not just how to use the software, but why the process changes matter. - Measure & Optimize

Track KPIs like time to reconcile, number of discrepancies, and recovered credits. Use this data to continuously improve.

Common Misconceptions About AP Matching Automation

“It’s too expensive for our size.”

In reality, automation ROI often pays back within months—even for mid-sized AP teams—because the cost of duplicate payments and missed credits adds up fast.

“We’ll lose control if we automate.”

Automation doesn’t remove control—it gives you better oversight with clearer audit trails and real-time exception reporting.

“Our process is too unique to automate.”

Modern platforms can handle custom matching rules, multiple currencies, and supplier-specific quirks.

FAQ: Automated Statement Matching Process

Q: How does automated matching handle supplier credits?

A: Credits are treated as transactions, matched to invoices or applied to balances automatically, with exceptions flagged for review.

Q: Can it work with partial payments?

A: Yes, advanced systems can match partials and payment schedules, reducing false exceptions.

Q: What’s the difference between AP matching automation and 3-way matching?

A: AP matching automation reconciles supplier statements to AP ledgers. 3-way matching verifies invoices against purchase orders and goods receipts. Many businesses use both for layered control.

The Bottom Line

Moving from manual to an automated statement matching process isn’t about keeping up with technology—it’s about protecting cash, improving supplier trust, and freeing your AP team from low-value, repetitive tasks.

With Statement Zen’s AP matching automation, you’ll get faster closes, fewer errors, and real-time insight into your payables. And in today’s fast-paced financial environment, that’s not just a nice-to-have—it’s a competitive edge.