In accounts payable, speed and accuracy aren’t just “nice to have” — they’re competitive advantages. When your AP team spends days or even weeks chasing discrepancies, matching invoices to statements, and reconciling balances, the costs are bigger than you think. Missed supplier credits. Duplicate payments. Slower month-end close. And perhaps most damaging of all: eroded trust with vendors.

That’s why AI statement matching is rewriting the rules of reconciliation. Instead of line-by-line, manual checks that drain hours from your AP staff, AI-powered systems now process, match, and reconcile data in minutes — often catching errors your team would miss entirely.

This is not about replacing people. It’s about equipping your AP team with the tools to handle a growing transaction load without growing headcount or sacrificing accuracy.

In this guide, we’ll break down:

- How AI transforms statement matching workflows

- Where AI-powered reconciliation delivers ROI

- Best practices for adopting AI in accounts payable

- Why automation doesn’t just speed up matching — it strengthens supplier relationships and audit readiness

The Old Way: Manual Matching and Reconciliation

Manual statement matching typically meant printing or exporting supplier statements, then cross-referencing every invoice, credit, and payment against your AP ledger. It’s slow, repetitive, and inherently prone to human error.

Even in “semi-automated” systems, your AP team still had to:

- Import statement data into spreadsheets

- Hunt for missing invoices

- Check for duplicate payments

- Flag discrepancies for further investigation

The result? Delays in closing the books, back-and-forth emails with suppliers, and inconsistencies in how reconciliation is performed across the team.

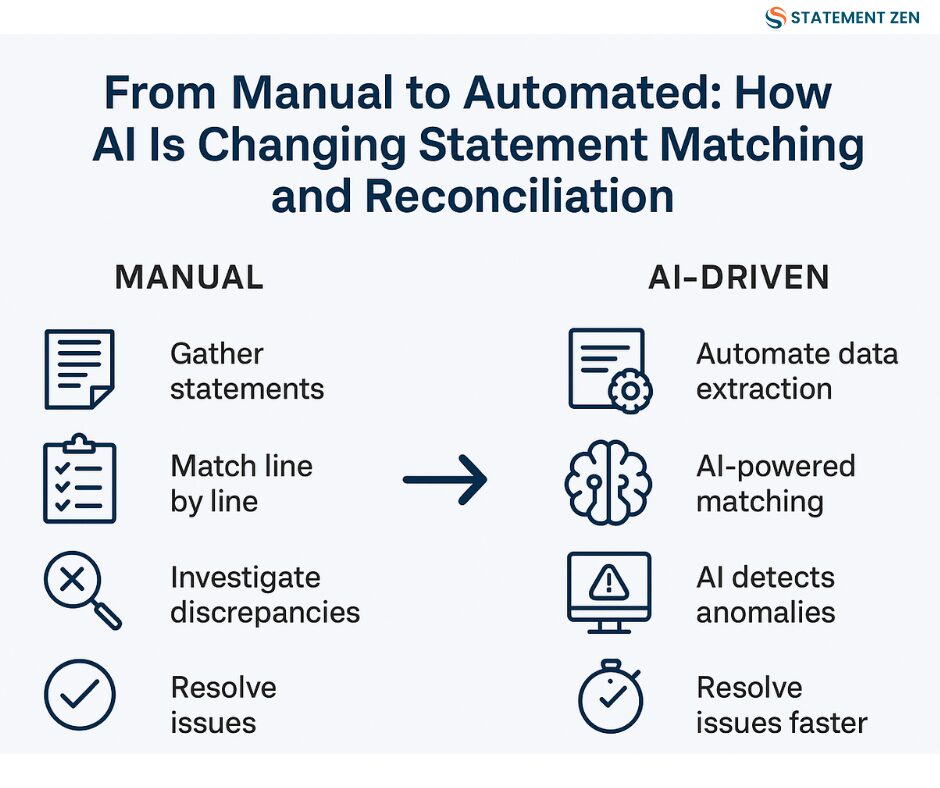

The AI Shift: From Reactive to Proactive Matching

AI changes the entire posture of the process. Instead of reacting to discrepancies after the fact, you’re detecting and preventing them in real time.

Here’s how AI in accounts payable works in reconciliation:

- Automated Data Ingestion – AI extracts statement data directly from PDFs, emails, or portals without manual keying.

- Intelligent Matching – Algorithms cross-verify every line item against your AP records, even if descriptions, formats, or reference numbers differ.

- Anomaly Detection – AI flags unusual transactions, missing credits, or potential duplicates instantly — often before they become a payment issue.

- Priority-Based Exception Handling – Instead of wading through every transaction, AP teams get a filtered list of the items that actually need attention.

- Continuous Learning – With every cycle, the AI model learns your suppliers’ formats, patterns, and quirks, making each reconciliation faster and more accurate than the last.

By moving to AI-powered statement reconciliation, you’re not just cutting hours from the process — you’re changing when and how those hours are spent.

Where AI Delivers ROI in Statement Matching

You can’t justify AI adoption with “it feels faster.” You need hard numbers. Let’s break it down:

1. Time Saved

If manual matching takes 10 minutes per statement and you process 500 statements a month, that’s 5,000 minutes — over 80 hours of labor. AI can process that in minutes, freeing your AP staff for higher-value work.

2. Errors Prevented

Duplicate payments, missing credits, and mismatched amounts cost organizations thousands per year. AI reconciliation software detects these issues early, preventing cash leakage and improving working capital.

3. Early Payment Discounts

By accelerating the matching process, invoices get approved faster, making it possible to consistently capture early payment discounts suppliers offer.

4. Audit Cost Reduction

AI automatically creates a clean, timestamped audit trail for every reconciliation cycle, reducing auditor time and internal overtime during audit prep.

Best Practices for AI-Powered Statement Matching

Switching to AI doesn’t mean just flipping a switch. To get the full benefit, follow these statement reconciliation best practices:

1. Start with Clean Data

AI works best with quality inputs. Standardize supplier invoice formats where possible, and maintain accurate supplier master data to reduce false exceptions.

2. Integrate with Your Existing AP Stack

Choose an AI reconciliation software that connects directly to your ERP or AP system to eliminate double-handling of data.

3. Use AI to Augment, Not Replace, Human Review

AI should do the heavy lifting — but your AP team still makes the final calls on exceptions and disputes.

4. Track Key Metrics

Measure the before-and-after impact on:

- Hours spent per reconciliation cycle

- Number of discrepancies detected and resolved

- Percentage of early payment discounts captured

- Supplier dispute rates

5. Prioritize Supplier Communication

When AI detects an issue, have a standard process for resolving it with suppliers quickly. This builds trust and avoids escalations.

Supplier Matching: The AI Advantage

Traditional supplier statement matching often falls apart when vendors use inconsistent formats or reference codes. AI solves this by recognizing patterns across different layouts, abbreviations, and naming conventions.

For example:

- “Inv #12345” in a statement and “Invoice 12345-AP” in your ledger are matched automatically, without manual review.

- Credits buried deep in multi-page PDFs are identified and applied before month-end, preventing missed opportunities.

When combined with automated statement matching from Statement Zen, you get not just accuracy, but the ability to monitor supplier performance over time — spotting vendors who consistently issue late credits or inaccurate statements.

AI-Powered Statement Reconciliation in Practice

Let’s take a real-world scenario.

A global manufacturing company processes over 1,200 supplier statements a month. Before AI, the AP team of six spent nearly two full weeks per month reconciling them — and still missed over $75,000 annually in supplier credits.

After implementing AI-powered statement reconciliation:

- Reconciliation time dropped from 80+ hours to under 6 hours per cycle

- Duplicate payments were reduced to near zero

- The company recovered over $60,000 in missed credits in the first year

- Early payment discounts increased by 15% due to faster approval cycles

The Strategic Payoff of AI in Accounts Payable

While most AP leaders focus on the immediate savings in labor and error reduction, the long-term benefits of AI adoption are just as compelling:

- Stronger Supplier Relationships – Faster, more accurate reconciliation builds trust and reduces friction.

- Scalability Without Headcount – Transaction volume can grow without proportionally increasing AP staffing.

- Better Cash Flow Management – With real-time visibility into liabilities, finance teams can make smarter payment timing decisions.

- Audit-Ready Compliance – Every transaction is tracked, matched, and logged automatically, reducing compliance risk.

FAQs About AI Statement Matching

Q: Is AI statement matching expensive to implement?

A: Not when you compare it to the cost of duplicate payments, missed credits, and labor hours lost to manual processing. Most companies see ROI within months.

Q: Will AI replace my AP team?

A: No. AI handles the repetitive matching work so your AP staff can focus on exceptions, supplier relationships, and process improvements.

Q: What if my suppliers all use different formats?

A: That’s where AI excels — it can interpret varying layouts and descriptions that would otherwise require manual review.

The Bottom Line

AI isn’t the future of statement matching and reconciliation — it’s the present. The organizations already leveraging it are closing their books faster, catching more discrepancies, and freeing their AP teams to focus on strategic work.

If you’re still relying on manual matching, you’re not just wasting time — you’re leaving money on the table.

Next step: See how Statement Zen’s AI-driven platform can streamline your reconciliation process, eliminate manual errors, and give you unmatched visibility into your AP workflow. Explore automated statement matching or learn more about our AI-powered statement reconciliation today. By leveraging advanced algorithms and machine learning, automating statement reconciliation benefits not only enhances accuracy but also significantly reduces processing time. This allows your finance team to focus on strategic initiatives rather than getting bogged down in tedious manual tasks. Experience the future of efficient financial operations and stay ahead of the competition with our innovative solutions.