Every Accounts Payable (AP) leader knows the drill: vendors send in statements, finance teams compare them against invoices and payments, and reconciliation becomes a painstaking routine. On paper, it sounds simple. In reality, it’s a time sink filled with missing invoices, unapplied credits, and spreadsheets that stretch for miles.

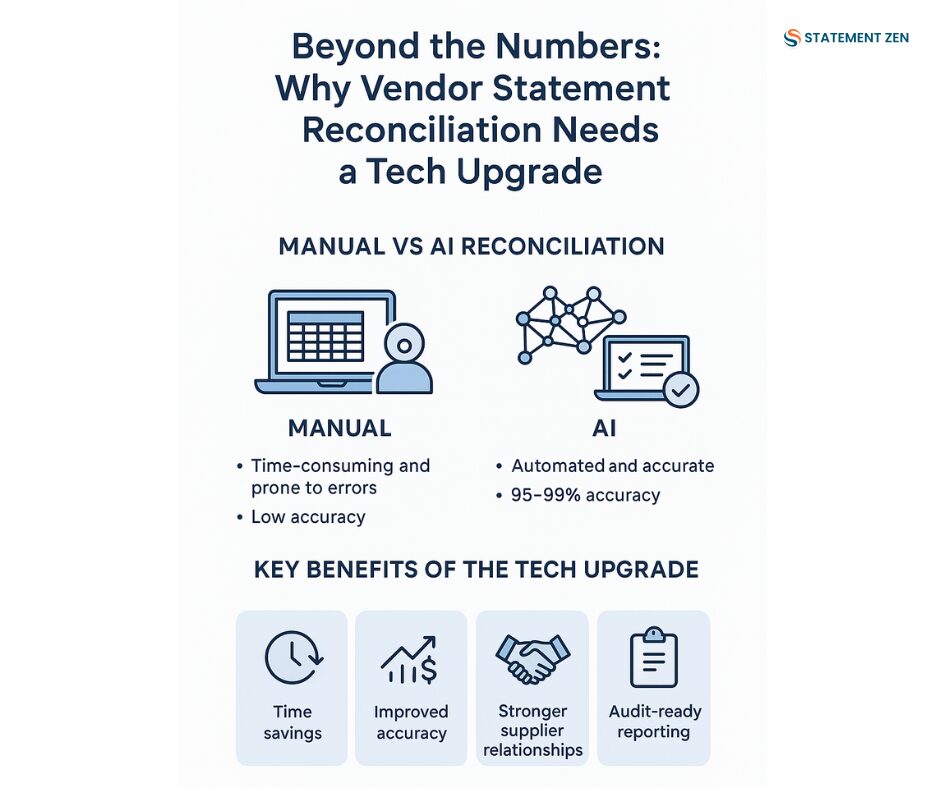

The truth is, vendor statement reconciliation is no longer just about balancing numbers. It’s about ensuring accuracy, protecting cash flow, avoiding disputes, and safeguarding supplier relationships. Yet most organizations still rely on outdated, manual methods that can’t keep up with modern finance demands.

Here’s the case for why reconciliation needs a tech-driven upgrade—and why AI-powered platforms like Statement Zen are becoming essential for AP teams that want to move from firefighting to financial leadership.

The Hidden Costs of Manual Vendor Statement Reconciliation

If you ask most AP managers how much time reconciliation takes, you’ll hear a common answer: too much. But the real cost goes beyond hours worked.

- Time Drain on Skilled Staff

AP professionals spend 30–40% of their time on reconciliations that could be automated. Instead of focusing on fraud prevention, supplier negotiations, or strategic analysis, they’re buried in spreadsheets. - Human Error is Inevitable

Even the best staff get fatigued. Misreading a line item or overlooking a credit note isn’t just possible—it’s inevitable in high-volume environments. Accuracy rates in manual reconciliations often hover around 85–92%, which leaves room for costly mistakes. - Supplier Disputes Damage Relationships

If your vendor says they sent an invoice, and your team missed it, you’re suddenly on the defensive. These disputes don’t just slow down AP—they strain trust with critical suppliers. - Cash Flow Blind Spots

A missed invoice means understated liabilities. An overlooked credit means cash locked up unnecessarily. Both distort cash flow forecasts and force CFOs to make decisions with incomplete data. - Audit Risks

Manual reconciliations lack a transparent audit trail. When auditors come knocking, recreating what happened is painful, slow, and expensive.

The bottom line? Manual reconciliation doesn’t just cost money—it costs accuracy, trust, and confidence.

Why “Good Enough” Reconciliation No Longer Works

For years, many companies viewed reconciliation as a back-office chore that “just has to get done.” But today’s finance leaders recognize it as a strategic process with direct business impact.

- Global supply chains demand timely, accurate reconciliations.

- Regulators and auditors expect transparent, automated controls.

- Vendors want disputes resolved quickly to keep business flowing.

- CFOs need real-time visibility into liabilities and cash flow.

In other words: reconciliation is no longer just about checking boxes. It’s about enabling the business to make confident decisions with reliable data. That’s why “good enough” manual methods are no longer enough.

The Tech Upgrade: AI-Powered Vendor Statement Reconciliation

Here’s where modern technology changes the game. Solutions like Statement Zen use AI, machine learning, and ERP integrations to automate reconciliation with accuracy rates of 95–99%.

What Does That Look Like in Practice?

- OCR That Reads Any Statement

AI-powered OCR (Optical Character Recognition) can process PDF, scanned, or even photographed statements—pulling line-level detail into a structured format automatically. - Automated Matching Across Systems

The platform matches vendor statement lines against invoices, POs, and payments stored in your ERP. It doesn’t just look for one-to-one matches—it identifies duplicates, unapplied credits, and exceptions. - Confidence Scoring for Accuracy

Matches come with a confidence rating. High-confidence items are auto-cleared, while exceptions are flagged for AP review. This hybrid approach ensures near-perfect accuracy. - Real-Time ERP Integration

Instead of batch uploads or exports, modern reconciliation software integrates directly with ERPs like Xero, QuickBooks, SAP, or Vista by Viewpoint. That means reconciliations are always based on real-time financial data. - Audit-Ready Reporting

Every match, adjustment, and exception is logged. Auditors can trace the entire process with a digital trail, reducing compliance risk and audit prep time.

The Impact of Tech-Driven Reconciliation

When AP teams embrace AI-powered reconciliation, the results speak for themselves:

- Time Savings: Reconciliation that once took 8–12 hours per 1,000 lines now takes less than 1 hour.

- Accuracy: Error rates drop by more than 50–70% compared to manual reconciliation.

- Faster Month-End Close: With reconciliations automated, finance teams close books faster and with greater confidence.

- Supplier Trust: Fewer disputes, faster resolution, and improved vendor relationships.

- Cash Flow Confidence: CFOs gain visibility into true liabilities, enabling better working capital management.

Case Study: From Manual to Automated

One mid-sized construction firm relied on AP clerks to manually reconcile hundreds of vendor statements every month in Excel. The process consumed 40+ hours monthly and still left gaps—suppliers routinely flagged missing invoices.

After adopting Statement Zen, the company saw:

- 98.5% reconciliation accuracy in the first 30 days

- 75% reduction in AP team workload

- Supplier disputes cut in half

- Audit prep time reduced by 50% thanks to digital reporting

For their CFO, the upgrade wasn’t just about saving time—it was about having reliable financial data to drive business decisions.

Overcoming Objections: “But We Already Reconcile in Excel”

Many finance leaders hesitate to change because they’ve always “made it work” with spreadsheets. But Excel-based reconciliation creates hidden risks:

- Lack of scalability – As volume grows, so does error risk.

- No audit trail – It’s almost impossible to track changes across multiple users.

- Data silos – Excel doesn’t integrate with ERPs in real-time.

- Talent retention – Skilled AP staff don’t want to spend careers doing manual checks.

The reality: sticking with Excel isn’t free—it costs accuracy, time, and staff morale.

FAQ: Beyond the Numbers in Vendor Statement Reconciliation

Is AI reconciliation 100% accurate?

No system is perfect, but AI-powered reconciliation achieves 95–99% accuracy, with exceptions flagged for human review. This hybrid approach ensures functionally 100% reliable reconciliations.

How hard is it to integrate with my ERP?

Platforms like Statement Zen offer pre-built integrations with leading ERPs. Implementation is measured in days or weeks, not months.

What happens if a vendor changes their statement format?

AI adapts. The system learns from new formats and applies machine learning to improve recognition over time.

Will this replace my AP staff?

No—the goal isn’t replacement, it’s elevation. Automation handles repetitive work, freeing AP teams for higher-value activities like fraud prevention and supplier engagement.

The Bottom Line: Why Now is the Time for a Tech Upgrade

Vendor statement reconciliation is no longer a back-office task you can afford to leave to spreadsheets. It’s a critical process that impacts cash flow, supplier trust, audit readiness, and strategic decision-making.

By upgrading to an AI-powered reconciliation platform like Statement Zen, finance leaders can:

- Eliminate manual errors

- Free up 70%+ of AP team capacity

- Gain real-time visibility into liabilities

- Build stronger supplier relationships

- Create an audit-ready digital process

In today’s finance environment, “good enough” reconciliation is no longer good enough. It’s time to move beyond the numbers and invest in a tech upgrade that drives accuracy, efficiency, and confidence across your entire AP process.