In accounts payable, speed without accuracy is dangerous — and accuracy without speed is expensive.

That’s why leading AP teams are moving away from manual statement reconciliation and toward automated solutions that deliver both.

This isn’t just a tech upgrade. It’s a strategic move that safeguards cash flow, strengthens supplier relationships, and keeps you compliant — without adding headcount or burning out your existing team.

The Core Problem with Manual Statement Reconciliation

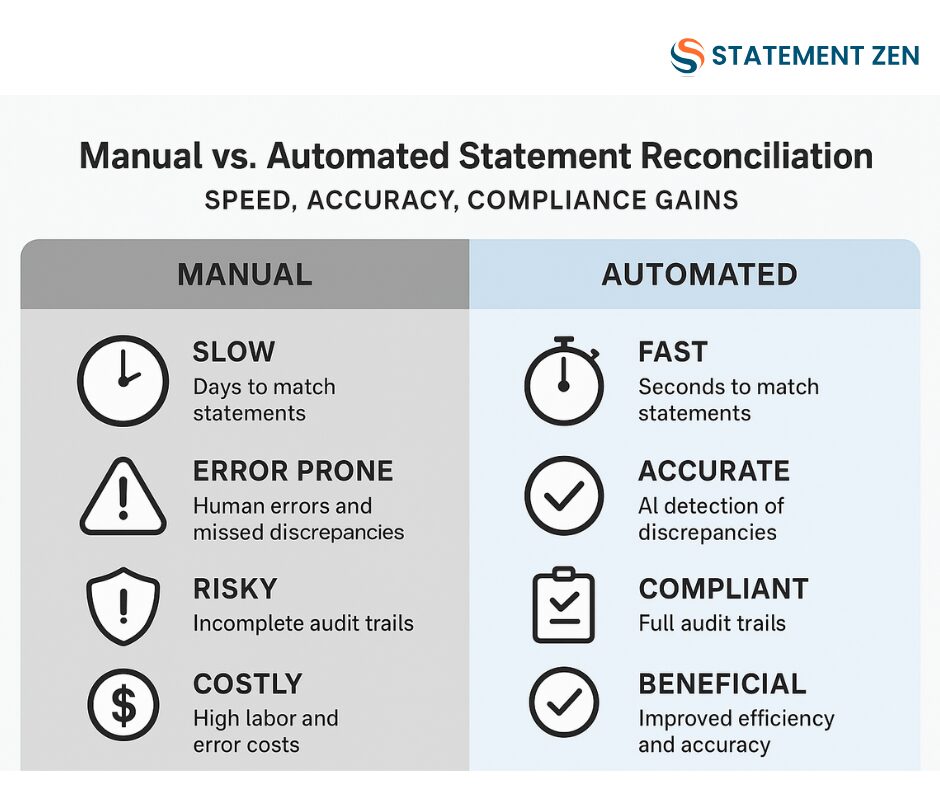

Manual reconciliation might feel “safe” because it’s familiar. But in reality, it’s a silent cost drain:

- Slow turnaround delays month-end close and pushes reporting deadlines.

- Human error leads to missed discrepancies, unapplied credits, and duplicate payments.

- Compliance risk increases when audit trails are incomplete or inconsistent.

- Supplier frustration grows when disputes take weeks to resolve.

In a modern AP environment, these issues aren’t just operational — they’re strategic. Every day you delay resolving a mismatch, you tie up working capital, increase compliance exposure, and risk supplier trust.

Why Automating Statement Reconciliation Changes the Game

An automated statement reconciliation system takes the exact same process you already know — but removes the bottlenecks that make it slow, error-prone, and stressful. By leveraging advanced algorithms and real-time data processing, this system enhances accuracy and speeds up the reconciliation process. As businesses strive for efficiency, modernizing statement matching processes becomes crucial in streamlining operations and reducing manual intervention. Consequently, organizations can focus on strategic initiatives rather than getting bogged down by tedious administrative tasks.

Here’s what changes when you automate:

- Speed – The system matches thousands of lines in seconds instead of hours.

- Accuracy – AI-powered detection spots discrepancies no human eye would catch.

- Compliance – Every match, adjustment, and exception is logged in a full audit trail.

- Scalability – Your team can handle 2x–5x the supplier volume without hiring.

The Automation Workflow: From Supplier Statement to Clear Ledger

Automated statement reconciliation doesn’t remove the process — it perfects it.

Step 1 – Statement Import

Upload supplier statements in bulk, in any format (PDF, Excel, CSV). OCR technology extracts the data instantly.

Step 2 – Intelligent Matching

The system compares statement lines against your AP ledger using matching algorithms that check:

- Invoice numbers

- Payment amounts and dates

- Credit notes

- Currency and tax fields

Step 3 – Discrepancy Detection

The software flags:

- Missing invoices

- Unapplied credits

- Duplicate payments

- Currency/tax mismatches

Step 4 – Exception Resolution

Your team gets a prioritized list of issues — so they can resolve high-value discrepancies first.

Step 5 – Audit Trail Creation

Every action is timestamped and stored, ready for internal review or external audit.

The Business Case for Automation

If your AP team spends 40 hours a month on reconciliation, automation can cut that to 5–10 hours.

Let’s put that into numbers:

| Metric | Manual | Automated | Savings |

|---|---|---|---|

| Staff Hours/Month | 40 | 8 | 32 hours |

| Hourly Rate | $30 | — | — |

| Monthly Labor Cost | $1,200 | $240 | $960 |

| Yearly Savings | — | — | $11,520 |

And that’s just labor. Add in duplicate payment prevention ($50k/year is common) and early payment discounts unlocked by faster closes, and the ROI multiplies quickly.

Compliance: Your Silent Risk Mitigator

Manual reconciliation is a compliance minefield: incomplete documentation, unclear approval chains, and unverifiable adjustments.

Automation gives you:

- Full visibility into every match and mismatch.

- Version control — no overwriting, no lost files.

- Export-ready audit trails for external reviews.

When regulators or auditors ask, you don’t scramble — you send them a neatly packaged report.

Real-World Example: Supplier Dispute Avoidance

One Statement Zen client — a manufacturing company with 500+ active suppliers — used to spend weeks resolving disputes over missing credits.

After implementing automated discrepancy detection (see how it works), they:

- Identified $18,000 in unapplied credits in the first month.

- Reduced supplier disputes by 73%.

- Cut statement reconciliation time by 80%.

The CFO’s verdict?

“We used to find problems months later. Now we fix them before they hit our books.”

Best Practices for Automated Statement Reconciliation

Automation is powerful — but it’s not magic. To maximize ROI, you need the right approach.

1. Standardize Your Data Inputs

Clean, consistent supplier data makes automation more accurate.

- Use uniform invoice numbering rules.

- Enforce standard currency/tax codes.

2. Prioritize High-Value Suppliers

Automate across the board, but resolve exceptions for your largest suppliers first — that’s where the cash impact is highest.

3. Track Metrics That Matter

Monitor:

- Exceptions detected per cycle

- Resolution time per exception

- Credit recovery value

4. Integrate with AP Automation

Link your reconciliation tool to your AP matching system (learn more about statement reconciliation) to create an end-to-end, error-proof workflow.

5. Review & Refine

Use post-close reviews to fine-tune your automation rules.

The Future: AI in Statement Reconciliation

The next evolution isn’t just “faster matching” — it’s predictive AP intelligence.

AI can:

- Predict which suppliers are most likely to submit incorrect statements.

- Flag potential discrepancies before statements even arrive.

- Learn from historical resolutions to auto-clear low-risk mismatches.

The goal? A zero-surprise close — where AP knows the final payable number before month-end even starts.

Why This Matters Now

Markets are tighter, compliance requirements are stricter, and supplier relationships are more valuable than ever.

If your AP team is still spending hours manually cross-checking numbers, you’re not just wasting time — you’re creating risk.

Automating statement reconciliation:

- Frees your team from repetitive checks.

- Improves supplier trust.

- Keeps you compliant without extra effort.

- Delivers measurable ROI in months, not years.

Soft CTA – Let’s Fix It Before It Costs You

If you want to stop losing time and money to manual reconciliation, the solution isn’t “work harder” — it’s work smarter with automation.

Statement Zen’s reconciliation engine handles the matching, flags the issues, and gives you a full audit trail — so your AP team can focus on resolution, not repetition.

See how Statement Zen detects discrepancies before they cost you.