Introduction: Why Finance Teams Struggle Without Automation

If you’re running an accounts payable (AP) team today, you’re probably facing the same recurring challenges:

- Endless piles of vendor statements and invoices.

- Manual reconciliation that takes hours per supplier.

- Missed credits and duplicate payments that silently drain cash flow.

The truth? Traditional finance processes weren’t built for today’s volume and speed of business. While ERPs like Xero, Sage, or Vista handle core bookkeeping, they don’t solve the biggest bottleneck: accurate, timely vendor statement reconciliation.

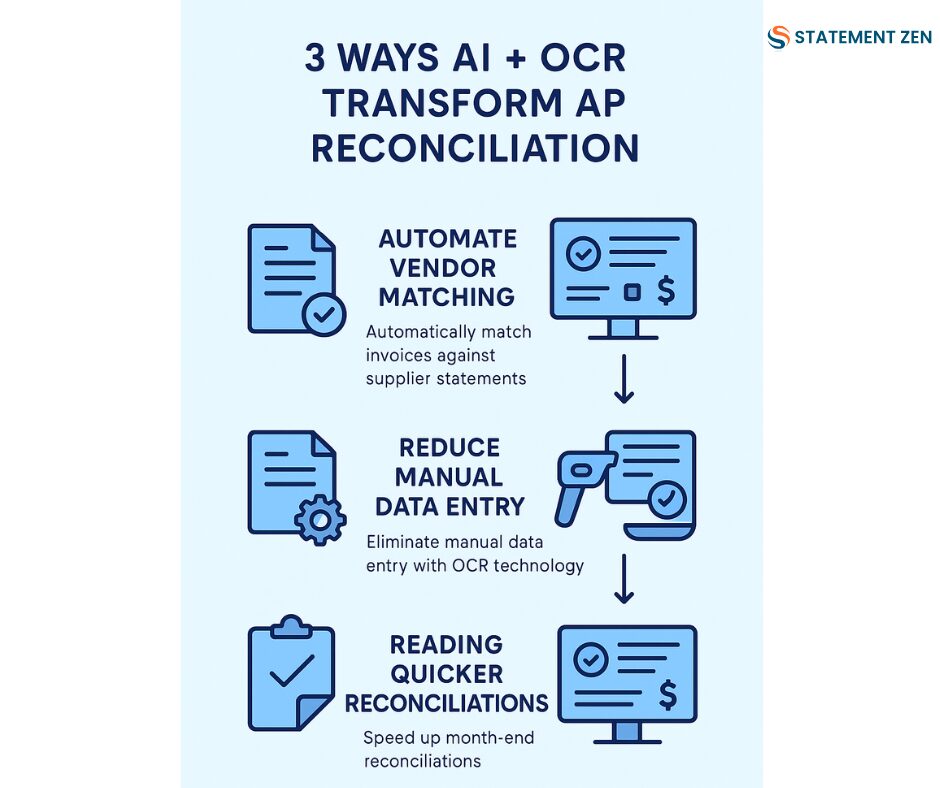

This is where AI-powered automation platforms like Statement Zen step in — combining OCR (Optical Character Recognition) with machine learning to eliminate tedious data entry, detect discrepancies instantly, and give AP teams their time back.

What Is AI-Powered Finance Automation?

Finance automation means using technology to reduce or eliminate manual work in AP, AR, and reconciliation processes.

An AI-powered platform takes this one step further:

- It uses machine learning to “learn” vendor formats and improve accuracy over time.

- It applies OCR technology to convert scanned or PDF vendor statements into structured financial data.

- It leverages rules + exception management so your team only touches the outliers, not the 90% of items that reconcile automatically.

Instead of finance teams spending 30+ hours per month reconciling vendor accounts, automation reduces this to minutes.

The Power of OCR in Vendor Statement Matching

OCR is the backbone of automated statement reconciliation.

Here’s how it works inside a platform like Statement Zen:

- Capture – Upload vendor statements in any format (PDF, image, Excel).

- Extract – OCR reads the data: supplier name, invoice numbers, dates, amounts.

- Standardize – AI cleans and formats data so it aligns with your ERP.

- Match – The platform compares vendor invoices against your AP ledger.

- Flag Exceptions – Missing invoices, duplicates, or payment mismatches are highlighted.

Instead of scrolling line by line, the system instantly surfaces discrepancies — giving your AP team an accurate view in seconds.

Why OCR Is Better Than Manual Entry

- Speed: OCR processes in seconds what a human would take hours to key in.

- Accuracy: AI reduces the risk of fat-finger errors.

- Scalability: One AP clerk can handle 10x more supplier statements.

- Audit-ready: Every extracted and matched item is logged for compliance.

Automating Supplier Statement Reconciliation

Vendor statement reconciliation is where finance teams bleed productivity. Manually comparing hundreds of invoices against supplier statements is slow and error-prone.

Automation fixes this by:

- Auto-Matching at Scale: Thousands of lines reconciled without lifting a finger.

- Smart Exception Management: Only mismatches are routed for review.

- Seamless ERP Sync: Updated records push back into systems like Xero, Sage, Vista, or NetSuite.

- Credit Recovery: Catch missed credits and overpayments before they impact cash flow.

Instead of firefighting every month-end, AP leaders can proactively manage supplier relationships with clean, accurate data.

Real-World Benefits for AP Teams

When AP automation platforms like Statement Zen are implemented, companies typically see:

- 70–90% Reduction in Manual Work

- Free AP staff from data entry so they can focus on higher-value analysis.

- 30–50% Faster Month-End Close

- No more last-minute scrambles — reconciliations are done continuously.

- Instant Visibility into Liabilities

- Know exactly what you owe and when, improving working capital decisions.

- Stronger Supplier Relationships

- Resolve disputes faster with clean, reconciled data.

- Audit-Ready Compliance

- Every action is logged, reducing audit risks and improving financial controls.

Why AI-Powered Statement Reconciliation Is the Future

Manual reconciliation is outdated. Spreadsheets and manual checks can’t keep up with:

- Increasing invoice volumes.

- Complex supplier terms.

- The demand for real-time financial visibility.

AI platforms solve this by:

- Continuously learning vendor formats (so accuracy improves over time).

- Detecting anomalies faster than a human eye ever could.

- Scaling instantly — whether you have 50 or 5,000 suppliers.

This isn’t just about saving time. It’s about creating a finance team that runs at the speed of business.

FAQ: People Also Ask

1. How accurate is OCR in vendor statement matching?

Modern OCR combined with AI achieves 95–99% accuracy, far higher than manual entry.

2. Can AI-powered reconciliation integrate with my ERP?

Yes. Statement Zen integrates with Xero, Vista by Viewpoint, and other ERP systems for seamless data flow.

3. Does this replace accountants?

No — it empowers accountants by removing repetitive work, so they can focus on analysis, compliance, and strategy.

4. How fast can AP teams see results?

Most teams see a productivity boost within the first month of using AI-driven reconciliation.

Call to Action: Take the Next Step

If your AP team is still buried in manual reconciliations, you’re not just wasting hours — you’re leaving money on the table through missed credits, duplicate payments, and poor visibility.

Statement Zen’s AI-powered reconciliation platform with OCR was built for finance leaders who want accuracy, speed, and scalability.