Vendor reconciliation is one of those financial processes that everyone knows is critical—but no one looks forward to doing manually. For accounts payable (AP) teams, the process of comparing vendor statements against internal records can feel like a never-ending audit. Every missing invoice, every duplicate charge, every credit note left unapplied has a direct impact on your cash flow, supplier relationships, and even audit readiness.

Here’s the truth: manual vendor reconciliation is costing your business time, money, and accuracy. In 2025, finance leaders are upgrading from spreadsheet-based workflows to AI-powered vendor reconciliation software like Statement Zen, which makes the process faster, smarter, and more reliable.

In this guide, we’ll cover:

- What vendor reconciliation actually involves (step by step)

- Best practices that top AP teams follow

- How automation can reduce effort by 70%+ while improving accuracy

What Is Vendor Reconciliation?

Vendor reconciliation is the process of matching a supplier’s statement of account (SOA) with your internal accounts payable ledger. The goal is to confirm that what the vendor claims you owe matches what your records show.

It typically involves:

- Checking that all invoices on the vendor statement exist in your system

- Ensuring payments recorded internally are also reflected in vendor records

- Identifying discrepancies such as missing invoices, overpayments, or unapplied credits

- Confirming balances so both you and your supplier agree on outstanding amounts

When done right, vendor reconciliation:

✅ Prevents overpayments

✅ Reduces disputes with suppliers

✅ Strengthens audit compliance

✅ Improves visibility into liabilities

Step-by-Step Vendor Reconciliation Process

While each company’s workflow may vary, here’s a typical reconciliation process:

Step 1: Collect Vendor Statements

Request monthly or quarterly statements from suppliers. Larger vendors often provide them automatically, while smaller ones may require reminders.

Step 2: Organize Internal Records

Pull your AP ledger and filter by vendor. Gather invoices, credit notes, debit notes, and payment details for the same period covered in the vendor’s statement.

Step 3: Compare Line Items

Manually (or via automation) match invoices and credits in the statement against internal records. Look for:

- Missing invoices not recorded internally

- Payments not acknowledged by the vendor

- Duplicate entries

- Unapplied credits or discounts

Step 4: Investigate Discrepancies

For each mismatch:

- Missing invoice? Request a copy from the supplier.

- Missing payment? Share remittance advice.

- Unapplied credit? Ask vendor to apply it.

Step 5: Adjust Records and Close

Update internal records as necessary, document resolutions, and confirm balances. This ensures both you and the vendor are aligned before the period closes.

Common Challenges with Manual Reconciliation

Despite its importance, vendor reconciliation is often delayed or skipped due to workload. Here’s why:

- Time-Consuming – A single vendor statement can take hours to review manually. Multiply that by dozens or hundreds of vendors.

- Error-Prone – Copy-pasting into spreadsheets creates room for missed invoices or miskeyed numbers.

- Lack of Visibility – Manual processes don’t provide real-time insights into liabilities.

- Strained Supplier Relationships – Delays in identifying mismatches can lead to disputes or mistrust.

- Audit Risks – Unreconciled vendor accounts can raise red flags in external audits.

Best Practices for Vendor Reconciliation

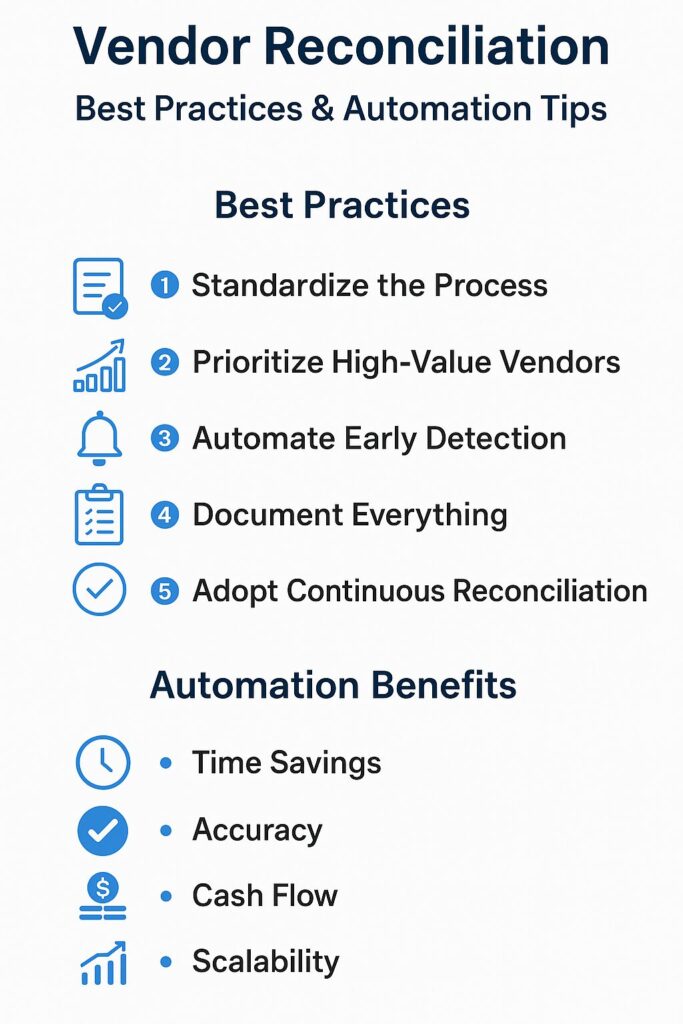

High-performing AP teams follow certain practices to ensure accuracy and efficiency:

- Standardize the Process

Use consistent reconciliation templates and checklists across vendors. This reduces variance and speeds up audits. - Prioritize High-Value Vendors

Focus first on suppliers with the largest spend, as errors here have the biggest impact. - Automate Early Detection

Set up alerts for duplicate invoices, missing credits, and overdue statements. - Document Everything

Keep a clear record of discrepancies, communications, and resolutions for audit readiness. - Adopt Continuous Reconciliation

Instead of waiting for month-end, reconcile continuously. This improves accuracy and reduces the bottleneck at close.

How Automation Transforms Vendor Reconciliation

This is where AI-powered automation tools like Statement Zen change the game. Instead of manually comparing PDFs and spreadsheets, software automatically ingests, matches, and flags discrepancies.

Here’s how automation helps:

- Optical Character Recognition (OCR)

Extracts invoice and statement data—even from scanned PDFs. - AI Matching Algorithms

Automatically matches invoices, payments, and credits against vendor statements. - Exception Handling

Flags only mismatches for review, reducing human effort by up to 80%. - Audit-Ready Reports

Generates clear reconciliation reports with timestamps and resolution notes. - ERP Integration

Syncs directly with systems like NetSuite, SAP, Oracle, or Microsoft Dynamics to ensure accuracy across platforms.

Quantifiable Benefits:

- Time Savings: Up to 70% reduction in manual reconciliation effort

- Accuracy: Over 98% match accuracy with AI reconciliation

- Cash Flow: Prevents costly overpayments and ensures credits are applied

- Scalability: Reconcile hundreds of vendor accounts without needing more headcount

Vendor Reconciliation Example: From Manual to Automated

Manual Process:

- AP clerk spends 3 hours reconciling a 5-page vendor statement

- 2 discrepancies found, requiring multiple emails back and forth

- Resolution takes 5 business days

Automated Process with Statement Zen:

- Vendor statement ingested automatically via email

- OCR extracts invoice numbers, dates, amounts

- AI matches 98% of line items instantly

- Exceptions flagged in a dashboard with recommended next steps

- Resolution in < 24 hours

FAQ: Vendor Reconciliation

Q: How often should we perform vendor reconciliation?

A: Best practice is monthly, though high-volume vendors should be reconciled continuously using automation.

Q: What’s the difference between invoice matching and vendor reconciliation?

A: Invoice matching ensures purchase orders, invoices, and receipts align internally. Vendor reconciliation goes further, ensuring your records match the vendor’s external statement.

Q: Can vendor reconciliation be automated in any ERP?

A: Yes. Tools like Statement Zen integrate with major ERP systems (SAP, NetSuite, Oracle, Microsoft Dynamics, QuickBooks, etc.) to reconcile seamlessly.

Final Thoughts: The Future of Vendor Reconciliation

Vendor reconciliation isn’t just about balancing numbers. It’s about trust—trust in your financial data, trust with your suppliers, and trust in your ability to avoid costly mistakes.

Manual reconciliation no longer meets the demands of modern finance. AI-powered automation is now the gold standard, enabling AP teams to cut hours of manual work, reduce risks, and improve supplier relationships.

With Statement Zen, your team can:

- Eliminate manual spreadsheet work

- Reconcile hundreds of vendor statements effortlessly

- Gain real-time visibility into liabilities

- Ensure compliance and audit readiness

In short, vendor reconciliation doesn’t have to be a bottleneck—with the right technology, it becomes a strategic advantage.