Why Cash Flow Management Starts With Vendor Statements

Ask any CFO or financial controller the #1 metric they watch daily — it’s not revenue. It’s cash flow.

Because when cash flow gets tight, you lose leverage. You can’t pay suppliers on time, negotiate discounts, or cover unexpected expenses. The ripple effects can stall growth and damage relationships.

But here’s the catch: cash flow clarity depends heavily on how you process vendor statements and invoices.

Vendor statements act as the “outside-in” truth of what you owe, while your invoices and ERP records show the “inside-out” view. When these don’t align — duplicate invoices, missing credits, overpayments — your cash flow projections are inaccurate. And inaccurate cash flow is the fastest way to lose control of your business finances.

The Hidden Cost of Manual Vendor Statement Processing

Most AP teams today still handle vendor statements manually. That means:

- Downloading PDF statements from supplier emails

- Manually reconciling against invoices in the ERP

- Highlighting discrepancies in Excel

- Chasing suppliers for missing documents

This eats up dozens of hours each month and still leaves room for error.

The three biggest impacts on cash flow are:

- Overpayments – Paying the same invoice twice or missing a credit note burns cash unnecessarily.

- Payment delays – Missed invoices delay payment processing, leading to late fees or strained supplier relationships.

- Inaccurate forecasting – Finance leaders can’t rely on AP data to predict outflows accurately, which skews cash planning.

In short: manual vendor statement processing doesn’t just waste time — it undermines your cash flow strategy.

Why Consistency in Invoice & Statement Processing Matters

One of the biggest challenges finance teams face is consistency.

Invoices and statements come in different formats: PDFs, spreadsheets, scanned images. Every supplier has a different layout. Humans reviewing them manually introduces subjectivity: one AP clerk might catch a discrepancy, another might miss it.

This inconsistency leads to:

- Bottlenecks in processing

- Disputes left unresolved

- Month-end reconciliation delays

The result? Cash flow projections shift like quicksand.

That’s why automation isn’t a nice-to-have anymore. It’s the only way to achieve consistent, error-free invoice and statement reconciliation — at scale.

How Automated Invoice & Statement Processing Improves Cash Flow

When you use a platform like Statement Zen, vendor statement reconciliation becomes automated, consistent, and transparent.

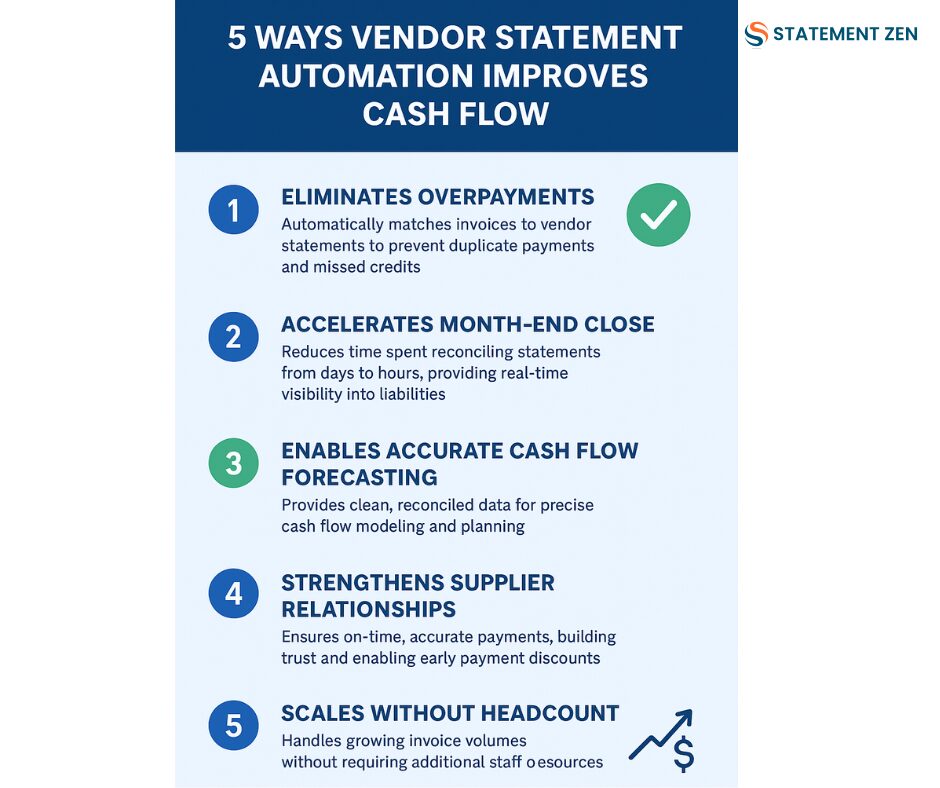

Here’s how it directly impacts cash flow management:

1. Eliminates Overpayments

Automation matches every line item on a supplier statement against your invoices in the ERP. If a duplicate or missing credit appears, it’s flagged instantly. That means:

- No more double payments

- No missed credits

- Cash preserved exactly where it should be

2. Accelerates Month-End Close

Instead of spending 5–10 days reconciling vendor statements, automated processing reduces it to hours. This speed means finance leaders have real-time visibility into liabilities, not outdated snapshots.

3. Enables Accurate Cash Flow Forecasting

With clean, reconciled data, your cash flow model isn’t guessing — it’s precise. You know what’s due, when it’s due, and what disputes could impact upcoming payments.

4. Strengthens Supplier Relationships

Cash flow isn’t just internal. Paying suppliers on time (and accurately) builds trust and often earns you early-payment discounts. Automation ensures you’re never late because of missing or misfiled invoices.

5. Scales Without Headcount

The old approach: more invoices = more clerks.

The automated approach: more invoices = same AP team, just smarter systems.

By removing manual processing, Statement Zen lets AP teams scale volume without adding payroll, keeping operating costs flat while improving cash flow control.

Real-World Example: How Automation Transforms Cash Flow

Case Study:

A mid-sized manufacturing firm processed over 2,000 supplier invoices monthly. Manual vendor statement reconciliation consumed 80+ hours of staff time each month. Errors led to:

- $50,000+ lost annually in duplicate/overpaid invoices

- A 12-day month-end close cycle

- Frustrated suppliers chasing missing payments

After implementing Statement Zen:

- Automated reconciliation matched 95% of statement items instantly

- Exceptions were flagged and resolved in 2–3 days (vs. weeks)

- Month-end close dropped to 4 days

- Cash flow forecasts became reliable, leading to smarter investment decisions

Result? They freed $75,000 in working capital in the first year alone.

FAQ: Vendor Statements, Cash Flow & Automation

Q: How do vendor statements directly impact cash flow?

A: They show what you owe suppliers. Errors or mismatches cause either overpayment (draining cash) or underpayment (causing supplier disputes). Both disrupt cash planning.

Q: Can automation fully replace manual statement checks?

A: Yes. With tools like Statement Zen, statement-to-invoice matching, discrepancy detection, and audit trails are automated. Humans only step in to resolve exceptions.

Q: What if our ERP system is complex?

A: Statement Zen integrates directly with leading ERPs (Xero, Vista by Viewpoint, NetSuite, Sage, Dynamics 365). Even custom ERP setups can connect via API or secure file transfers.

Best Practices: Automating Vendor Statement Processing for Better Cash Flow

- Start with high-volume suppliers – Automating their statements delivers the fastest ROI.

- Set tolerance thresholds – Decide what discrepancies (e.g., small rounding errors) need human review.

- Integrate directly into your ERP – Eliminate double handling of data.

- Audit exceptions monthly – Use exception reports to tighten supplier compliance and prevent recurring issues.

- Track metrics – Measure time saved, reduction in overpayments, and improved forecast accuracy to prove ROI.

Final Word: Vendor Statements Are the Key to Cash Flow Clarity

Cash flow is king — but it’s only as accurate as the data feeding it. And vendor statements are one of the most overlooked inputs in AP.

Manual reconciliation creates bottlenecks, errors, and wasted cash. Automated invoice and statement processing with Statement Zen flips the script:

- Clean, accurate vendor data

- Faster reconciliations

- Predictable cash outflows

- Stronger supplier relationships

The companies that thrive in today’s market aren’t the ones working harder. They’re the ones working smarter — automating the tedious parts of AP so finance leaders can focus on strategy.

👉 Ready to see how Statement Zen can improve your cash flow by automating vendor statement reconciliation?

See How It Works