The Accounts Payable Bottleneck Nobody Talks About

If your finance team is still managing accounts payable (AP) manually, you’re carrying hidden costs that quietly drain profitability.

Think about it: every manual touch — typing invoice data, printing approvals, emailing suppliers for missing invoices — is an expense. It’s also a liability. Human error can lead to duplicate payments, missed credits, and strained supplier relationships.

Here’s the kicker: the cost of processing a single invoice manually can exceed $15, according to the Institute of Finance & Management. With automation, it often drops to under $3. Multiply that across thousands of invoices per year and you’re looking at six-figure savings potential.

But cost savings are only the start. Accounts payable automation changes how your finance department operates, shifting AP from a back-office expense to a strategic function that supports cash flow optimization, vendor relationships, and even fraud prevention.

What Exactly Is Accounts Payable Automation?

Accounts payable automation is the use of software to digitize, streamline, and, where possible, fully automate the AP process — from invoice receipt and statement matching to approvals and payment.

Instead of chasing paper trails and manually reconciling accounts, your team gets:

- Centralized supplier documents

- Automatic data extraction from invoices and statements

- Automated matching against your ERP or accounting records

- Digital approval workflows that cut days off processing time

- Real-time reporting for full financial visibility

When done right, AP automation isn’t about replacing your AP team. It’s about removing the repetitive, low-value work so they can focus on resolving discrepancies, negotiating payment terms, and ensuring the business gets the best financial outcomes.

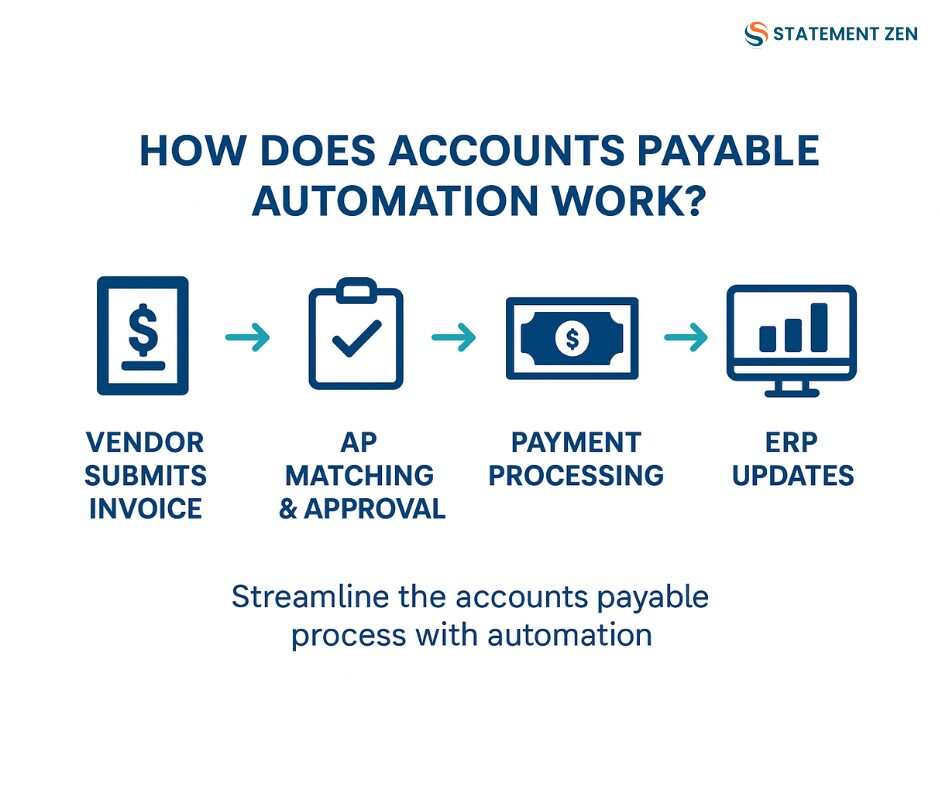

The End-to-End AP Automation Workflow

Here’s how accounts payable automation works from start to finish, using Statement Zen as an example.

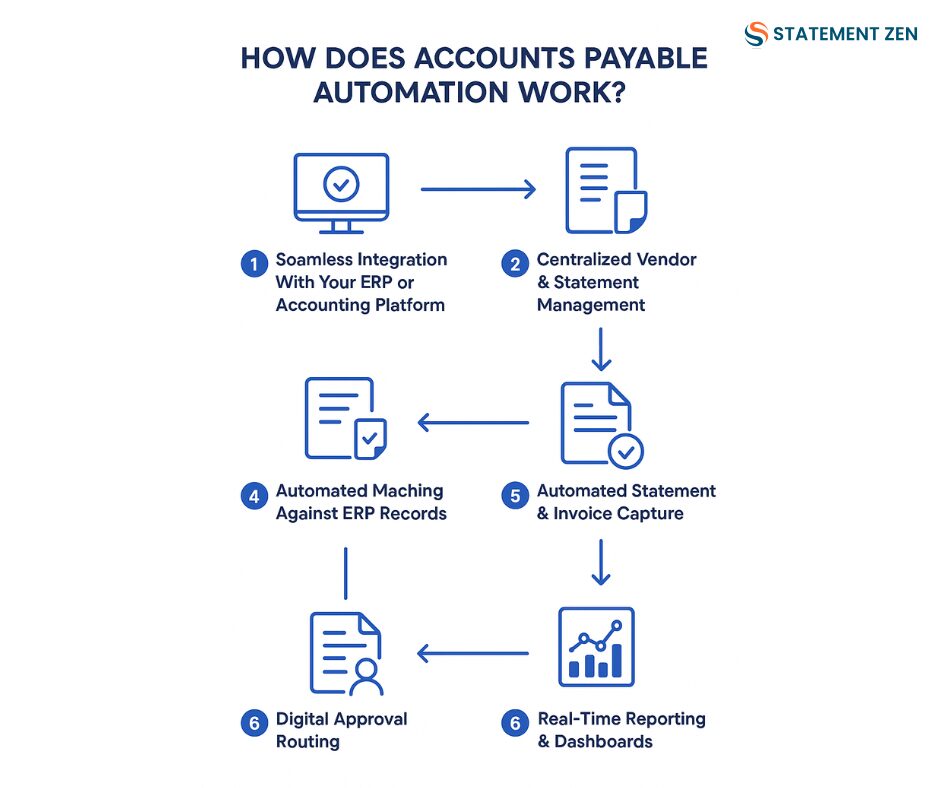

1. Seamless Integration With Your ERP or Accounting Platform

Automation begins by linking directly to your core financial system — whether that’s Xero, QuickBooks, MYOB, or a large-scale ERP like Vista by Viewpoint or NetSuite.

Why this matters:

- No more duplicate data entry — every update is reflected in both systems instantly.

- One source of truth means fewer discrepancies.

- Historical records are preserved for compliance.

Example: A construction company integrating Statement Zen with Vista was able to reduce invoice data entry by 100% for matched transactions.

2. Centralized Vendor & Statement Management

Gone are the days of digging through email folders or network drives for supplier statements. AP automation tools store all supplier statements, invoices, and correspondence in one secure, searchable dashboard.

Benefits:

- All vendor documents are organized by supplier.

- Easy to track communication history for disputes.

- No risk of losing key documents during audits.

3. Automated Statement & Invoice Capture

With AP automation, you simply upload your supplier statements — PDFs, scanned images, or even smartphone photos. Optical Character Recognition (OCR) technology extracts all relevant details:

- Supplier name

- Invoice numbers

- Amounts

- Dates

- Credits

Old way: A staff member spends hours keying in invoice lines.

New way: Data extraction takes seconds, with accuracy rates often exceeding 98%.

4. Automated Matching Against ERP Records

This is where the magic happens. The system compares extracted statement data to your ERP or accounting records to identify:

- Missing invoices (recorded by the supplier but not in your books)

- Duplicate invoices (flagged before double payment)

- Unapplied credits (which can be used to offset future payments)

- Quantity or price discrepancies (before payment is made)

Value:

- Immediate visibility into errors that cost money.

- Faster resolution with suppliers because issues are identified early.

5. Digital Approval Routing

Once invoices pass matching rules, they’re automatically routed to the correct approver based on predefined rules — department, project, spend threshold, etc.

Impact:

- Approval bottlenecks are eliminated.

- Finance teams can set up escalation rules for overdue approvals.

- Faster processing means you can capture early payment discounts.

6. Real-Time Reporting & Dashboards

You get instant visibility into AP performance metrics:

- Total outstanding invoices

- Discrepancy trends by supplier

- Average approval times

- Credit recovery opportunities

Because every action — upload, match, approval — is timestamped, you’re always audit-ready.

Why Automation Beats Manual Processing Every Time

| Factor | Manual Processing | Automated Processing |

|---|---|---|

| Speed | Days to process | Minutes to process |

| Accuracy | Prone to human error | Accuracy >98% with OCR + matching rules |

| Visibility | Limited, scattered data | Centralized dashboard, real-time insights |

| Scalability | More invoices = more headcount | Scales without additional staff |

| Auditability | Manual paper trails, hard to track actions | Full digital audit logs |

A Real-World Transformation Story

A mid-sized engineering firm was processing supplier statements manually, spending over 80 staff hours per month on reconciliation alone. After implementing Statement Zen:

- Reconciliation time dropped to under 3 hours per month.

- They recovered over $50,000 in missed supplier credits in the first quarter.

- Month-end close was completed 4 days earlier consistently.

- AP staff were reallocated to supplier negotiation and cash flow forecasting.

Common Questions About AP Automation

Q: Will AP automation work with my existing software?

Yes — most solutions integrate with major accounting platforms and ERPs. Statement Zen, for example, works with Xero, QuickBooks, MYOB, Vista by Viewpoint, and more.

Q: Is my financial data safe in the cloud?

Absolutely. Enterprise-grade encryption, role-based access controls, and secure backups ensure your data remains protected.

Q: Does this mean I don’t need an AP team anymore?

Not at all. AP automation removes low-value, repetitive tasks so your AP team can focus on exception handling, supplier relationships, and strategic finance work.

Final Takeaway

So, how does accounts payable automation work?

It takes what used to be a slow, error-prone, manual process and transforms it into a fast, accurate, and transparent workflow. By combining OCR data capture, automated statement matching, digital approval routing, and real-time reporting, automation delivers:

- Lower cost per invoice processed.

- Faster processing and payment cycles.

- Improved accuracy and reduced errors.

- Better supplier relationships through timely payments and proactive dispute resolution.

The choice is clear: manual AP processes aren’t just inefficient — they’re expensive. If you want to close faster, recover more credits, and give your AP team the tools to focus on high-value work, AP automation isn’t a “nice-to-have.” It’s essential.