In accounts payable (AP), two terms often get used interchangeably — statement matching and reconciliation.

But here’s the truth: while both are critical to maintaining accurate financial records, they serve different purposes, follow different workflows, and solve different problems.

Confusing them (or worse, skipping one) can lead to duplicate payments, missed credits, compliance issues, and month-end headaches that ripple across your finance team.

This guide breaks down statement matching vs. reconciliation — what each process does, when to use them, and how to combine both for maximum AP accuracy and efficiency.

What Is Statement Matching?

Statement matching is the process of comparing supplier statements to your AP ledger or ERP records to ensure all invoices, credits, and payments are accounted for.

Think of it as your real-time invoice accuracy filter. If an invoice is missing, duplicated, or overcharged, statement matching will catch it before payment is made.

Core Steps in Statement Matching

- Collect the supplier statement — typically monthly.

- Match line items to your AP ledger:

- Invoice numbers

- Dates

- Amounts

- Flag discrepancies — missing invoices, unapplied credits, mismatched amounts.

- Resolve issues — contact suppliers or internal teams to clarify and fix errors.

- Document findings for audit readiness.

Primary Goals

- Detect missing invoices before they hold up month-end close.

- Ensure all supplier credits are applied in full and on time.

- Prevent duplicate or erroneous payments.

- Build supplier trust through accuracy.

What Is Reconciliation?

Reconciliation is a broader end-of-period financial balancing process where your AP records are aligned with your general ledger (GL) and bank statements.

It’s about confirming that every transaction in your books matches what actually happened — across all accounts, not just supplier invoices.

Core Steps in Reconciliation

- Extract period-end data from the AP ledger, GL, and bank records.

- Identify mismatches — missing entries, mispostings, timing differences.

- Adjust entries to ensure the books reflect reality.

- Document supporting evidence for compliance and audits.

Primary Goals

- Confirm the completeness and accuracy of financial reports.

- Detect fraud, posting errors, or timing discrepancies.

- Satisfy compliance and audit requirements.

- Support accurate tax filings.

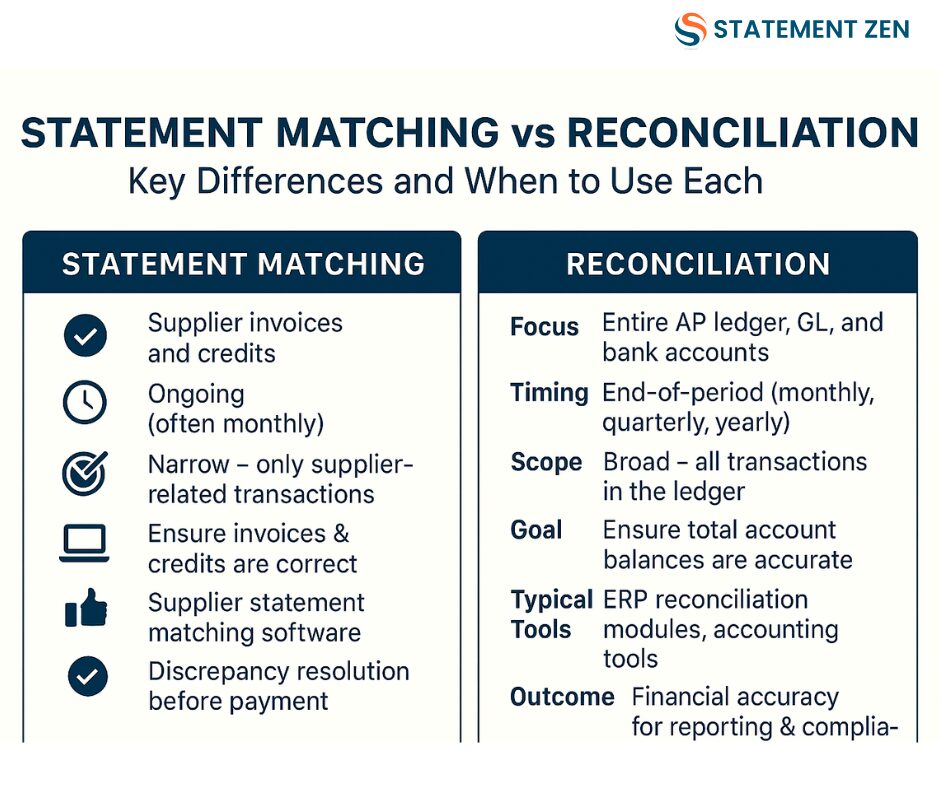

Key Differences: Statement Matching vs. Reconciliation

| Feature | Statement Matching | Reconciliation |

|---|---|---|

| Focus | Supplier invoices and credits | Entire AP ledger, GL, and bank accounts |

| Timing | Ongoing (often monthly) | End-of-period (monthly, quarterly, yearly) |

| Scope | Narrow – only supplier-related transactions | Broad – all transactions in the ledger |

| Goal | Ensure invoices & credits are correct | Ensure total account balances are accurate |

| Typical Tools | Supplier statement matching software | ERP reconciliation modules, accounting tools |

| Outcome | Discrepancy resolution before payment | Financial accuracy for reporting & compliance |

When to Use Each Process

Use Statement Matching When:

- You want real-time accuracy in AP transactions.

- Supplier relationships rely on on-time, error-free payments.

- You’re aiming to catch missing invoices or credits before month-end.

- You’re implementing AP automation to reduce manual checks.

Use Reconciliation When:

- You’re preparing period-end financial statements.

- You need to validate AP balances against your GL and bank records.

- Your goal is compliance, audit readiness, and tax accuracy.

- You suspect system posting errors or fraud.

Why You Need Both

A common mistake is thinking reconciliation alone will catch all issues.

Here’s the problem: by the time reconciliation happens, it’s too late to prevent many AP errors from affecting cash flow or supplier relationships.

Statement matching catches discrepancies early.

Reconciliation confirms financial accuracy at the end.

Think of it like this:

- Statement matching is your early-warning system.

- Reconciliation is your final safety check.

Best Practices for Statement Matching

- Automate whenever possible

Manual matching wastes hours and introduces human error. Tools like Statement Zen automatically import supplier statements, compare them to your AP ledger, and flag discrepancies in seconds. - Standardize supplier formats

Ask suppliers to send statements in a consistent, machine-readable format (CSV, XML, EDI) to speed up matching. - Set matching thresholds

Define tolerance limits for minor discrepancies (e.g., rounding differences) to avoid unnecessary investigations. - Track recurring discrepancies

If a supplier’s invoices regularly mismatch, address the root cause with them directly.

Best Practices for Reconciliation

- Schedule regular reconciliations

Don’t wait until year-end — monthly or quarterly reconciliations keep issues small. - Use version-controlled checklists

Ensure every step is completed the same way every period. - Investigate timing differences

Payment date mismatches often come from bank processing delays — document them to avoid confusion. - Leverage integrated ERP tools

Let your ERP automatically pull and compare data from AP, GL, and bank feeds.

How Statement Zen Brings Them Together

At Statement Zen, we see statement matching and reconciliation as two halves of the same AP accuracy strategy.

Our platform:

- Automates supplier statement matching to detect missing invoices, unapplied credits, and duplicate entries in real time.

- Feeds clean, accurate AP data into your reconciliation process, making month-end close faster and easier.

- Reduces manual rework by preventing errors from ever reaching reconciliation.

This means:

- Faster month-end close.

- Fewer supplier disputes.

- Better compliance outcomes.

Case Example: The Cost of Skipping Statement Matching

A mid-sized construction company relied solely on monthly reconciliation. They thought that was enough — until a year-end audit revealed:

- $84,000 in missed supplier credits

- Multiple duplicate payments to the same vendor

- A six-week delay in closing the year’s accounts

By adopting Statement Zen’s automated statement matching:

- Missing invoices and credits are flagged within 24 hours of statement upload.

- Duplicate payments have dropped to zero.

- Month-end close time has been cut by 40%.

FAQ: Statement Matching vs. Reconciliation

Q: Can reconciliation replace statement matching?

No — reconciliation happens too late to prevent most AP errors from impacting cash flow.

Q: Is statement matching only for large companies?

Not at all. Even small AP teams benefit from avoiding duplicate payments and missed credits.

Q: How often should I perform statement matching?

Monthly is typical, but high-volume AP departments may do it weekly or even daily with automation.

Next Steps

If you’re relying solely on reconciliation, you’re running your AP process with a safety net that’s already on the ground.

Statement matching catches the fall before it happens — and when integrated with reconciliation, it creates a bulletproof AP accuracy system.

Discover how Statement Zen can help your team: